There's a lot of marketspeak in here but the concepts put forth are:

1) Unlike a natural system, stock market "weather" can be caused intentionally

2) Because it's been impossible to make money in traditional trading, firms that must make money (pension funds, for example) are making money with short strategies on synthetic indices (whenever anyone talks about "shorting the Vix" they're talking about betting against a synthetic fund designed to track the most common volatility index)

3) The behavior of that index has become decoupled from what it references as a result

4) complications ensue

- The hurricane is not more or less likely to hit because more hurricane insurance has been written. In the financial markets this is not true. The more people write financial insurance, the more likely it is that a disaster will happen, because the people who know you have sold the insurance can make it happen. So you have to monitor what other people are doing.

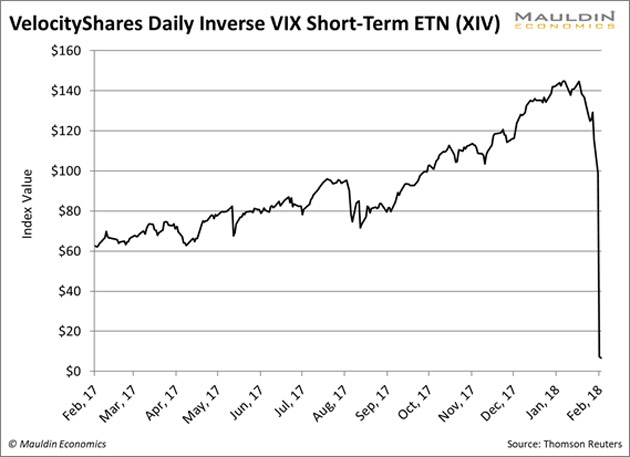

I thought it was worth waking this thread up to add a chart of XIV making beautiful returns until it didn't.

https://www.bloombergquint.com/markets/2018/02/08/volatility-funds-worked-as-intended-that-s-the-problem The inverse volatility ETNs were created as sort of a response to VXX: If a long volatility product lost money constantly over time, would a short-volatility product mint gold coins? In fact, it did. Volatility veterans know that is the nature of short-volatility strategies -- you make money for five to 10 years and then you give back all the gains in one day in a giant tsunami. Less sophisticated people never bothered to learn the years of option theory, and saw a ticker that went up every day.But VXX didn’t quite behave quite like people thought a VIX ETF should behave. It went down all the time. If you think about it, this makes sense: Options decay, and if you hold an ETF that is based on an index of options, it will lose value over time. And so, VXX lost more than 99 percent of its value over time, with several reverse splits along the way. Some people got angry at VXX, but it did exactly what it was supposed to do. It bought VIX futures and rolled them to the next month, and with an upward-sloping term structure of volatility, it incurred huge amounts of negative carry in the process

I think the metaphor "picking up nickels in front of a steam roller" has been applied to low-volatility-will-stay-low-vol strategies. Implying it's easy and fun and pain-free up until you get pinned.

Phrase originally coined, in fact, to describe Victor Hagani/LTCM's financial strategy. After the fact, of course. While they were doing it they were fucking brilliant. When Genius Failed is a great book to read because unlike most financial tell-alls, it isn't a book about smart people doing dumb things out of hubris and showing their ass as a result; it's about "here's this brilliant strategy/process that everyone agrees is genius until suddenly the market moves against you and bam you're fucked."

Why are bonds and stocks valuations stretched? Why is the trading world bereft of interest income? I don't mean to come off pitying institutional investors, but how are they making money?

Treasury bonds aren't paying much at all. Other interest uses treasury yields as a baseline. Interest rates went down to promote economic recovery. Lower interest [hopefully] causes money to shift from financial investments to investments which grow the broader economy. Some money does, some money just finds more risky or overcrowded investments.

I understand what interest rates are. I'm curious if we've entered some new era, though. I'd point you to this discussion, specifically this comment which shows the flat interest rate of the last decade or so. Interest rates in the US are only just now starting to rise, with rates in Europe and Japan at near-zero or negative. This article posits that levels of low volatility are a terrible omen, suggesting that the economy is tepid and underwhelming and possibly on the verge of belching up some rotten shit. Yet this tepid and underwhelming economy has been the beneficiary of as stimulative a program of monetary policy--for over a decade--that it could feasibly have hoped for. What happens if shit goes sideways? The gas pedal has already been depressed. Do we go to 11?

I wholeheartedly recommend you add this book to your reading list. It's the best basis I know of for "so you don't understand the stock market, but you understand that you have an IRA and you want to not lose it." In that book, Malkiel pretty much explains all financial behavior as the tension between Fundamentals Theory and Greater Fool Theory (which, per Keynes, he refers to as "Firm Foundation theory" and "Castle in the air theory"). I'm probably going out on a limb here, but I think you could make an analogy between Fundamentals/Greater Fool and Beta/Alpha gains. Fundamentals Theory postulates that a stock is worth what it's worth, or more, what you'd lose if you didn't have it. If you have a thousand shares of GM, and each share pays out a dollar every quarter, you make four thousand dollars a year off your shares of GM, plus whatever you've made or lost on the difference between when you buy it and when you sell it. From that, you subtract what you'd make if you'd taken the money you've sunk into GM stock and put it in a zero-risk CD and you have the fundamental value of your GM stock - profit minus opportunity cost. Greater Fool Theory holds that everything above is rubbish - the value of the stock is whatever you can sell it for. Pets.com stock was worth a shit-ton at some point, and nothing at a point shortly thereafter. If you converted your options in Groupon to shares at the IPO, your options were worth whatever you could sell your Groupon shares for, and are now worth dogshit. By comparison, beta gains are the money you make on a stock just by holding it - because the pooling of resources and the market for capital are multiplicative on the economics of business, and because nobody would buy shares in something if they didn't expect to make it back more often than not, markets have long-term beta gains. A rising tide raises all ships. Beta gains are whatever the market makes. SPY tracks pure beta. Alpha gains, on the other hand, are money you make at the expense of someone else. A stock that makes an alpha gain is a stock that rises higher than the market, which means that somewhere out there there's a stock that rises lower than the market. For every overperformer there's an underperformer. Beta gains track what the stock market is "fundamentally" worth, really. Alpha gains track what you can sell it for. They can also track a stock that fundamentally has great value... but the market cap on Tesla is higher than the market cap on GM. Fundamentally, Tesla has never paid a dividend. Fundamentally, Tesla has yet to turn a profit. Fundamentally, GM has been paying a dividend every quarter since nineteen diggity two. But there are plenty of greater fools who will happily pay ten times the price of a share of GM for a share of Tesla. And so long as you can sell your shares to someone else for more than you paid for them, you made money. __________________________________________________________________________ So. Long walk to get to the answer but it's like this: interest rates are an important part of beta gains. When interest rates are high, that means that you make more money just by lending out cash. When interest rates are high, the fundamental value of a stock is lessened because shit, you could make money on CDs or municipal bonds or something equally stable. Interest rates right now are low which is causing a lot of deviant behavior. It's causing a lot of unstable trades. It's causing a normalization of ideas like of course Tesla is worth ten times as much per share as GM. I've heard it argued that the Seattle housing market is hyperinflated simply because Amazon isn't required to have any profits in order to justify its stratospheric valuation - think about it. Their business model is to suck the profits out of selling things and then make it up on volume. They are literally attempting a monopoly of commerce and the closer they get (until they reach the singularity) the less money they'll make. They're at like a thousand dollars a share. And you can write all this and go yep, sounds crazy but volatility is down. That means that the perceived craziness of the market is actually dropping. It gets stupider and stupider but by any metric, everybody who trades is going "meh" and going about their business as if Tesla is actually worth $300 a share. It means that the prices of the market are being driven not by fundamentals theory but by greater fool theory - - which works until there is no greater fool. The lower the volatility measures, the less the market believes in a limited supply of fools. Actual volatility is pretty goddamn breathtaking: billions of dollars in market cap spiking because of Trump's verbal diarrhea. That is not the sign of a high-stability market, yet the indicators say the opposite. Supposedly consumer confidence is at an all-time high yet one of my newsletters pointed out that the percentage of Americans who think they'll be able to retire is at an all-time low. So there's likely to be a correction. And it may not be an elegant one.

This was fascinating. My reading list is finally going to see some daylight this summer. I recall you making a "play money" account after you conducted a self-education of finance. How has that portfolio been doing?

TD Ameritrade will give you a full-function technical platform and $100k of fake money to play with just for opening an account. And I don't think you even need much money in it. Just like with my real money, I went to cash and haven't much fucked with it since. Thing is, they give you the fake money account to convince you you have the knowledge to fuck around with the real money account. So I have a very real worry that if I start doing dumb shit like option splits and forex I'll convince myself I actually know what's going on. And confession? I'm a fundamentalist. I think you oughtta be making money off dividends and shit and that approach isn't entertaining. Right now the market is being dominated by greater fool theory - Facebook, Apple, Amazon, Tesla and Google are all worth a lot of money because of course they are, shut up shut up shut up. The stuff that's actually selling product and issuing dividends is still in the mud. Should I be modeling how rich I'd be if I'd thrown all my money in Apple? Maybe. But I hate Apple right now and it would make me feel dirty. Plus, I've got a lot of money invested in a birth center right now and it has most assuredly curbed my financial adventurism. It should probably feel better to play the ponies with fake money, but the more I dip my toe in it these days the more convinced I am that the market is insane. And I don't want the crazy rubbing off on me.

Beyond the basics of interest rates, I don't know enough to sort good information from people just finding whichever conclusion they want to. Interest rates have stayed near zero for 10 years because the economy hasn't "heated up" enough to make the fed raise it. I think they want to wait until inflation gets a little higher before raising more. Inflation is often the result of too-low rates, but inflation has been really low the past 10 years, proving a bunch of warnings wrong. There are tons of simple explanations that X caused a slow recovery and Y is the sure-fire fix. The only simple explanation that made much sense to me is that a financial crisis is the worst kind of crisis, because the loss of trust in the system as recovery. That explanation doesn't come with a solution though. ---------- So we've got divergence of expectation and outcome, and dark omens of volitility in the last few months. It's possible for pressure to bleed of slowly or pop with a bang. Or pressure could keep building for longer than anyone expects. If it pops, rates don't have a lot of room to go down, but quantitative easing is an option too.

You said it.I don't know enough to sort good information from people just finding whichever conclusion they want to.

As simply as I can: Arbitrage, options trading, currency trading and many other semi-exotic-sounding trading behaviors involve "leverage". You may have heard the phrase "margin trading" which involves "leverage" which is market-speak for "trading with money you don't have." Should you ever choose to play with Forex, for example, you will quickly learn that you can't make any real money without playing with REAL money - a "standard lot" in forex is 100,000 (dollars, euros, yuan, whatever). A "mini lot" is 10,000. And if the renminbi drops .05% against the dollar over the course of an evening, if you have twenty lots of dollars that you trade for the equivalent in renminbi, you made ten thousand dollars! Congrats! Of course, you staked two million dollars. And it might go back .07% tomorrow in which case you lost five thousand dollars. And you're renting that money, by the way, it isn't yours. You have leveraged the cash to play Forex. Enter George Soros."At their desks on the other side of the Atlantic, Druckenmiller and Soros saw the rate hikes as an act of desperation by a dying man. They were a signal that the end was nigh--and that it was time for one last push to sell the life out of the British currency."