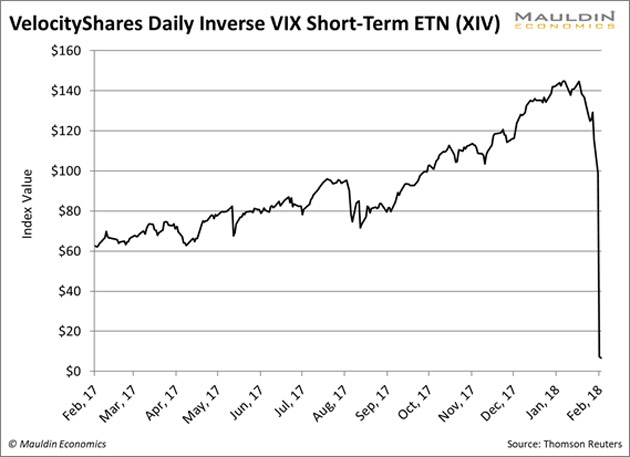

https://www.bloombergquint.com/markets/2018/02/08/volatility-funds-worked-as-intended-that-s-the-problem The inverse volatility ETNs were created as sort of a response to VXX: If a long volatility product lost money constantly over time, would a short-volatility product mint gold coins? In fact, it did. Volatility veterans know that is the nature of short-volatility strategies -- you make money for five to 10 years and then you give back all the gains in one day in a giant tsunami. Less sophisticated people never bothered to learn the years of option theory, and saw a ticker that went up every day.But VXX didn’t quite behave quite like people thought a VIX ETF should behave. It went down all the time. If you think about it, this makes sense: Options decay, and if you hold an ETF that is based on an index of options, it will lose value over time. And so, VXX lost more than 99 percent of its value over time, with several reverse splits along the way. Some people got angry at VXX, but it did exactly what it was supposed to do. It bought VIX futures and rolled them to the next month, and with an upward-sloping term structure of volatility, it incurred huge amounts of negative carry in the process