Krugman's title is shit but the column is interesting.

- For the past few months, economists who track short-term developments have been noting a peculiar divergence between “soft” and “hard” data. Soft data are things like surveys of consumer and business confidence; hard data are things like actual retail sales. Normally these data tell similar stories (which is why the soft data are useful as a sort of early warning system for the coming hard data). Since the 2016 election, however, the two kinds of data have diverged, with reported confidence surging — and, yes, a bump in stocks — but no real sign of a pickup in economic activity.

The funny thing about that confidence surge, however, was that it was very much along partisan lines — a sharp decline among Democrats, but a huge rise among Republicans. This raises the obvious question: Were those reporting a huge increase in optimism really feeling that much better about their economic prospects, or were they simply using the survey as an opportunity to affirm the rightness of their vote?

When Trump won in November, stocks saw a small but not insignificant surge. But banks and institutional investors have been downgrading their projections for GDP growth all quarter once reality started to set in: the Trump effect is a whole lotta bullshit. In response to the tax plan, stock and bond markets barely registered a response. It's kind of unbelievable. Rich people were told that their president wants to shatter the record for largest tax break for rich people in the history of tax breaks for rich people, and the markets were mute. My only fear is that the Katrina moment, when it comes, still won't disabuse people of Trump. Question for everyone older than me (probably most people): is it just me, or is there a growing sense that the economic pie is becoming fixed and that other people's gains mean less for you? In other words, am I imagining that people are getting cagier about the future? Or is my timeline too small?

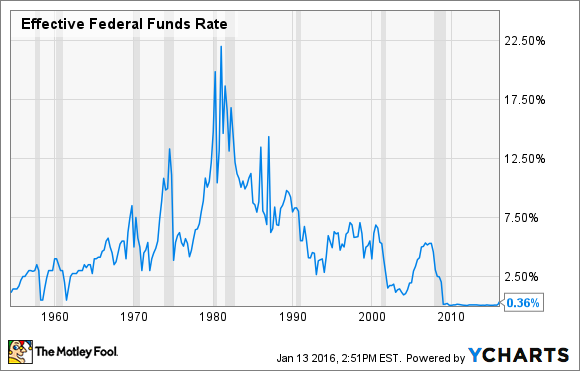

Talking heads occasionally lose their shit when the bond markets and stock markets diverge, which they are most assuredly doing. One of the guys I follow avidly is David Rosenberg, who put it pretty simply - either the stock market or the bond market is wrong and we're about to find out which. The other thing to keep in mind is the stratospheric rise of the stock market right now is because of a handful of stocks (Apple, Facebook, Google, Gilead etc). The broader market remains stagnant. I went to cash 2nd week in november and backtesting my portfolio to there, I gave up on half a percent of gains. Meanwhile, the Nasdaq is up what? 11%? The very real status quo everyone is experiencing is vanishing yields. When interest rates are near zero, you don't make any money by just holding onto money and when most of the trading is in dark pools, you don't make any money unless you're in those dark pools. Because you need to loan a lot of it to make any money at half a percent over prime, cash is suddenly everywhere. And since cash is suddenly everywhere, it's seeping into everything. So that house you want to buy? You're competing against a REIT that's fronting for a hedge fund that's fronting for a pension fund that's trying to meet its obligations. You're not going to win against Wall Street because they can pay cash while you have to convince Fannie Mae you're worth the risk. On the flip side, large investment firms are now having to buy up houses a few hundred at a time in order to make their yields.Question for everyone older than me (probably most people): is it just me, or is there a growing sense that the economic pie is becoming fixed and that other people's gains mean less for you?

Why were interest rates so high in the 80s? I'm again reminded of a line from some reporting on the causes of the oughts-housing bubble. There was suddenly twice as much money looking for investments but there were not twice as many good investments. Takeaway is to continue investing/creating real value. Skills, my health, thank-my-lucky-stars this house.

I think the factor of 2 is low. I also think it's simplistic to say "there was suddenly twice as much money looking for investments" without acknowledging the cause. Interest rates were high in the '80s because of Paul Volcker.

I just want you to know that this is a wise question to ask.Question for everyone older than me (probably most people): is it just me, or is there a growing sense that the economic pie is becoming fixed and that other people's gains mean less for you? In other words, am I imagining that people are getting cagier about the future? Or is my timeline too small?