- There is also the nagging problem of the narrowness of the stock market's rally since Election Day. Consider that on Friday there were just 220 net advancing issues on the NYSE compared to nearly 2,000 during Monday's "Hillary is saved!" rally. Or that just four Dow stocks — Goldman Sachs (GS), Caterpillar (CAT), JPMorgan (JPM) and Home Depot (HD) — were responsible for half the index's gain last week. Or that the performance divergence between the Dow and the tech-heavy Nasdaq (down on fears of a clampdown on skilled H-1B visas used heavily by Silicon Valley) was the largest since the financial crisis.

Ok. So let me see if I am reading this right. Numbers look higher as a whole on the market right now, but that's just because a few businesses are selling really well to kind of fluff things up. Businesses are confused about how to spend their money because they think the American government isn't going to prop the economy up anymore with cheap loans and low interest rates. To make matters worse, inflation is a huge issue and China (who we owe a lot of money to) and Mexico (which is our good neighbor and economic friend) have uncertain futures to the value of their currencies and if Trump becomes an economic isolationist, this will agravate their currency problems. Am I getting that right? How does inflation affect housing? Cause I'm asking for a friend . . .

Its good for cheaper housing bad for house prices. Reason being that most houses prices are driven by ability to make house payments. At 4% rates you can afford to buy significantly more house than say 8% because a fixed payment of 2k a month pays for a 600k house at 4% but only a 300k house at 8. Lowering rates naturally drove house prices to the moon, raising rates will slowly cause them to come back to earth. How does inflation affect housing? Cause I'm asking for a friend . . .

a 2k a month payment at 8% for 30 years gets you a $275k loan. a 2k a month payment at 4% for 30 years gets you a $420k loan. A 4% interest rate hike decreases your buying power by $145k, not $300k So you're not wrong in theory, but you're off by a factor of two in practice. Mortgage insurance, property taxes and all the rest complicate the issue further and eat further into the difference.

The numbers you use are a better estimate. I used really rough mental math and it came out to a larger error than I expected. Probably because I didn't account for principal payment. As you state the effect is probably additionally decreased due to insurance costs.

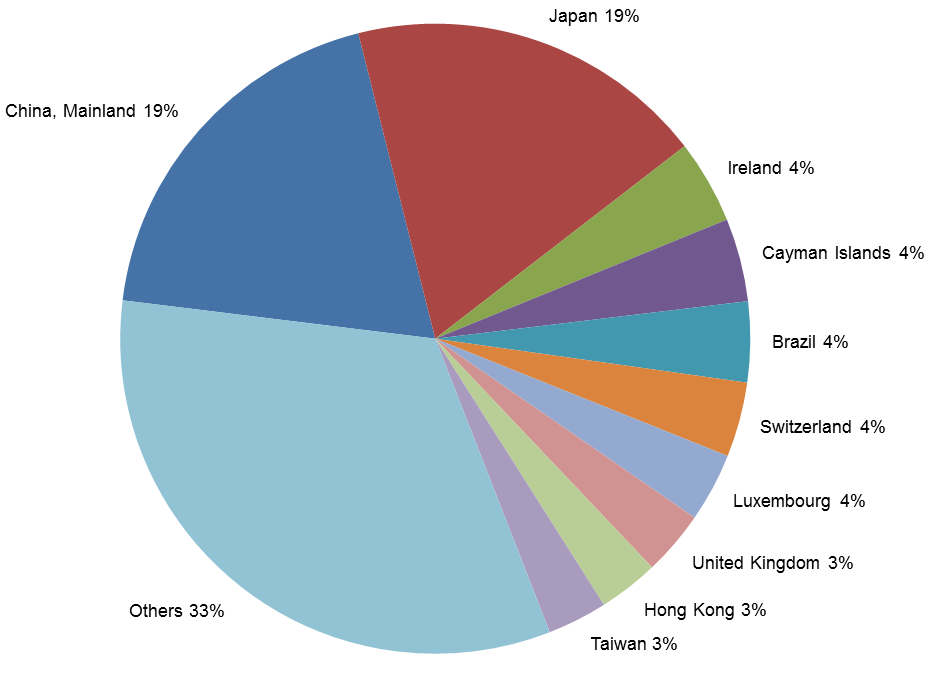

Yes. Exactly this. They even list the four individual stocks the drove the index. This is something that gets lost in the mix - a friend of mine wrote Treasure Planet. Treasure planet bombed its opening weekend. Disney had to restate their earnings. This dragged down the entire entertainment sector. My buddy was directly responsible for the Dow tanking 400 points. It's a highly complex system and highly unstable and right now, there are splinters of the index that are doing really well. The aggregate is rallying, but that aggregate is driven by a handful of overperformers that are overcoming the vast majority of underperformers. Mmmmm.... I'm not exactly comfortable with "businesses" as a group and "confused" as a motive. Basically, for the past several years money has been cheap to get (low interest rates) and the market as a whole is predicting that cheap money is about to come to an end (higher interest rates). This is causing market players to borrow now to buy stuff now because they predict they won't be able to afford it later. Does that make sense? Inflation is a controversial issue and most traditional economists would argue that we have been incapable of generating enough of it since the crash in 2008. This has caused the radical imbalances like the aforementioned cheap cash and all it entails. Most people are banking that inflation will go up. If we're talking about protectionist trade policies, though, devaluing the dollar actually does the job while inflating the dollar increases the flow of imports. This is why, as mentioned in the article, China is whacking the shit out of the Yuan so that everybody else can afford cheap Chinese goods (when you have a command economy and your currency is worth "whatever I say" x "the dollar" you can do this). It's also easy to say "we're owned by the Chinese" but of all US debt, 2/3rds of it is actually inter-agency debt (which means money one part of the government owes another part of the government). The rest of it breaks down like this: Source, current Sept 2016 Interest rates go up. Loans get more expensive. Monthly payments don't go as far because you're paying more interest. Available pool of money goes down because the service cost goes up which... ...well, the correlation isn't direct, but there's a loose correlation between rising interest rates and falling real housing prices. "real housing prices" assumes that your salary keeps up with inflation, which... ...well, Trump's president so anybody who says they know is either lying or kidding themselves. I'll say this: I watch real estate avidly and I'm starting to see shit that reminds me of 2006.Numbers look higher as a whole on the market right now, but that's just because a few businesses are selling really well to kind of fluff things up.

Businesses are confused about how to spend their money because they think the American government isn't going to prop the economy up anymore with cheap loans and low interest rates.

To make matters worse, inflation is a huge issue and China (who we owe a lot of money to) and Mexico (which is our good neighbor and economic friend) have uncertain futures to the value of their currencies and if Trump becomes an economic isolationist, this will agravate their currency problems.

Am I getting that right? How does inflation affect housing? Cause I'm asking for a friend . . .

Thanks again for this. I'll have to look further into inflation and currency control I guess, because both concepts are still pretty nebulous to me. Heck, mk telling me that people actually speculate on the value of certain currencies was news to me. That housing graph paints a good picture too, by the way.

Doesn't the fact that it's those specific four (two banks, a home materials company, and a construction (among others) equipment manufacturer) suggest that people are getting ready to start building and buying again? Bear with me please as I think this through. I was going to say that this implies an expectation of increased home prices, but I think it's better to say that it implies an increased value in real estate, which isn't necessarily the same thing. The crash of 2008 showed pretty clearly that the market can have an interest in improperly pricing some things (or can do so out of stupidity). This in theory could be consistent with what you're saying--if interest rates are expected to rise and housing prices are expected to drop, this could mean investors expect more demand for real estate. Even if people can buy less house for the same amount of money, I'd be curious to know to what extent seeing lower "sticker" prices on real estate influences demand. But U.S. real estate is also used as a form of savings by rich Chinese. Perhaps, then, those four companies being the winners, again assuming it implies an impending increase in construction, could mean there's the expectation of even more (or at least continued) foreign investment in this regard. Of the two things I've suggested, I find this to be more likely. And it's a good thing. I want the Chinese, especially the Chinese ruling class, to have a vested interest in our continued stability, both economic and material.

For the record, we're discussing hypotheses for market behavior and I don't think either of us have the standing to do so. That said, REITs are getting pounded which more directly reflects the sentiment on housing. The construction boom is directly linked to Trump's infrastructure plan and, from the article,China devalued its currency to the lowest level since breaking its dollar peg in 2010 in an effort to reinvigorate an overindebted, overinvested, export-dependant economy. This creates its own problem, as China's bad loan issues are exacerbated by the capital outflows encouraged by the currency weakening. Moreover, this is exactly the type of currency manipulation Trump wants the U.S. Treasury to crack down against. The iShares FTSE/Xinhua China 25 Index ETF (FXI) fell to test four-month lows on Friday, down more than 8 precent from its early October high.

I'm on the internet, that's all the standing I need! I don't see anything in those links that necessarily undercuts what I'm saying. Real estate holdings are used as refuge by wealthy Chinese, not the Chinese government. Their own country's economic woes are all the more reason to invest in something tangible and not subject to the same fluctuations. Plus, the first article you mention is mostly devoted to why you should invest in those very trusts. So doesn't exactly suggest the same level of pessimism. Trump's discussed infrastructure spending is awfully nebulous--as is typical, he has given few details, and there's a lot to suggest that it won't be implemented in the way he proposes. So I'm not convinced that such a theoretical plan is really the cause, or at least a major one.For the record, we're discussing hypotheses for market behavior and I don't think either of us have the standing to do so.