Bonus: the "Cost of Thriving Index":

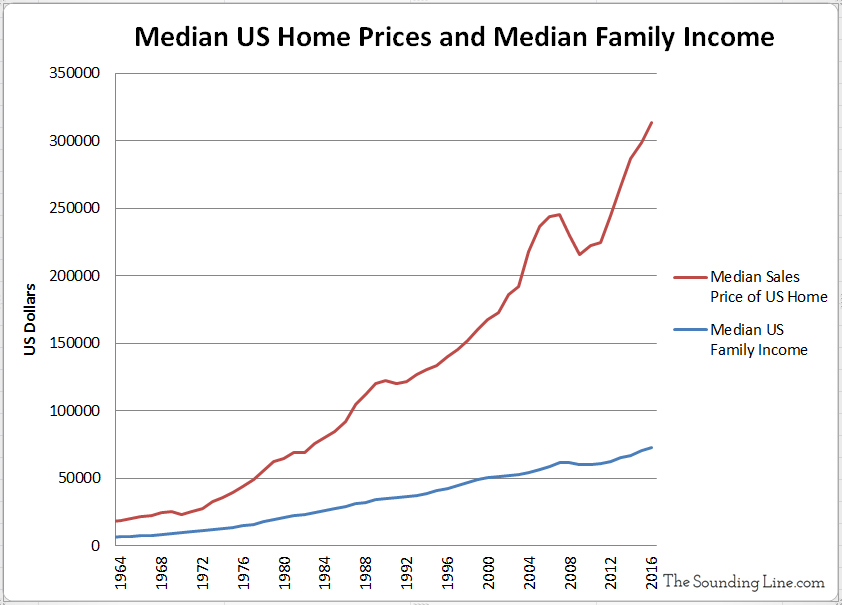

- In 1985, the COTI stood at 303—the median male worker needed thirty weeks of income to afford a house, a car, health care, and education. By 2018, the COTI had increased to 53—a full-time job was insufficient to afford these items, let alone the others that a family needs. A generation ago, the worker could be confident in his ability to provide his family not only with the basics of food, clothing, and shelter, but also with the middle-class essentials of a house, a car, health care, and education. Now he cannot. Public programs may provide those things for him, a second earner may work as well, or his family may do without, while his television may be larger than ever. The implications of each are surely worth pondering. But the fact that he can no longer provide middle-class security to a family is an unavoidable economic reality of the modern era.

The other thing no one talks about is subscription services. It feels like everything these days instead of saving up for a lump sum takes a small amount of every pay check which in theory sounds great, but in practice takes from everyone, leaving everyone worse off. The new SaaS profit model is slowly draining the economy of much needed support. It's only a matter of time to see which wins -- profitability and monthly subscriptions, or lack of wage growth for twenty years while everything moves to monthly subscriptions instead of once-bought services.

I understand more or less why the cost of college and healthcare have gone way up, but why have the cost of transportation and housing gone up so much? And what systemic issues caused the increase? I don't understand what needs to be fixed to make those things more affordable. Government price fixing is a shitty band-aid in this case. What are the root causes?

College: loans are available to everyone and cannot be disbursed except under death. They are also risk-free to institutions as the federal government guarantees student loans. Consequence: Colleges can charge as much as they want, because students can borrow as much as they want, because the government will get their money one way or the other. Outcome: radically higher college costs, radically higher student loan debt. Healthcare: consumers and providers have no way to negotiate prices, insurance companies and manufacturers maximize shareholder value. Consequence: massive price increases. Outcome: Insurance as retention tool, healthcare as social striator. Transportation: Increased fuel economy and safety standards, combined with comfort additions to cope with increased commutes, raise the median price of a car. Consequence: a median price increase from $21k to $38k ("cheap" cars in 1980 were cheaper than cheap cars today, but were also less safe, less reliable and less comfortable). Outcome: greater used market, greater repairs, lower sales of new cars, higher margins of new cars. Housing: Lower interest rates lead to fewer opportunities for investment has led to a rise in real estate prices. When borrowing money gets cheaper, big purchases get cheaper. Elizabeth Warren has a different take: the general decline of American schools, due to the decline in investement in American schools, has led to hot-spotting of advantageous school districts which are are paid for by property taxes. As a consequence, houses in good school districts have gone up precipitously while houses everywhere else have just gone up. College: stop guaranteeing student loans, and allow students to disburse college debt in bankruptcy. Healthcare: treat it like a utility. That's what medicare/medicaid are already. Transportation: tax vehicles by curb weight. A Honda CRX got 80mpg in 1987. It also weighed 1700 lbs. Even a Civic weighed 600lb less in 1987. Reduce weight, reduce operating cost, reduce materials. Housing: stop pretending that every human is entitled to own a house. Housing is owned by municipalities throughout much of Europe. If we did that in the US it would definitely put a roof on prices. If the federal government purchased houses in distressed areas and leased or sold them to "pioneers" you might see vast swaths of hipsters rewilding Appalachia. There are a number of ways to deal with housing, but they all start by not treating housing as a bank.Government price fixing is a shitty band-aid in this case. What are the root causes?

It appears you have commented on a not-coronavirus post. I’m probably gonna stock up on liquor and non-perishables, maybe a month’s worth of each. Well, at least enough non-perishables to compliment my existing pantry.

My sincere apologies, I was genuinely convinced that you were meaning to post that comment in one of the 10 coronavirus threads the other day. Sorry! It was I who made the mistake.