The thrilling sequal to

"worth it" doesn't even figure into it - that's money someone was promised. Millions of someones. "work this job for shit pay and at least you won't have to eat cat food in your golden years." If you "work to curb entitlements", though, you're a fiscally prudent legislator. If you "renege on promises" you're a horrible human being.

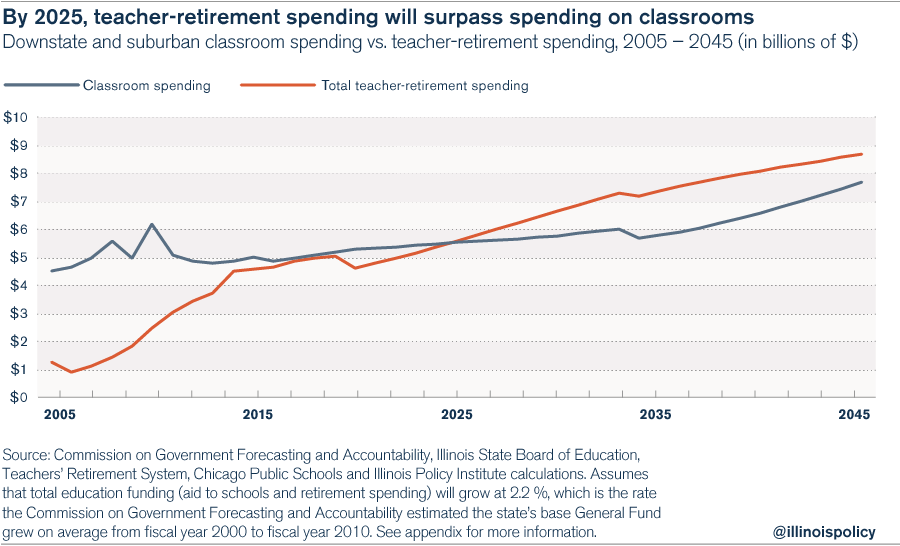

It's already happening in my kid's school district. Money ain't there, so who you gonna starve? The pensions? Naah because that involves bankruptcy can't do that. The bondholders? naaah default on a bond and you'll never be able to borrow again. The current teachers? Yep boy howdy. Fire a bunch of 'em, freeze the pay of others, kick the arts programs in the head and we can afford to keep paying the people whose pensions were promised them in '75 when interest rates were fucking NINE PERCENT.

Fuck dude, I got a pension. Rub me for luck.

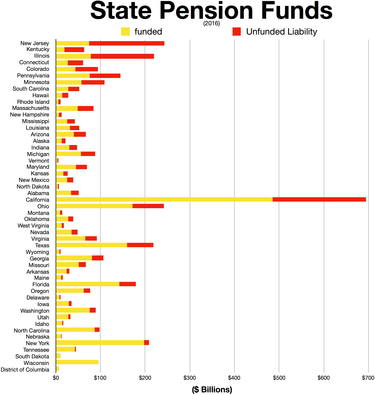

Thing is, the PBGC has $423m a year to cover the 19 trillion in outstanding pensions. CalPERS alone is a $300b pension fund that, to cover its obligations, needs to be $440b.

So. State of California government employees only. Only discussion here. Current gap is 330 times what the PBGC can cover. And the gap is getting bigger. So the odds that anyone under 50 ever sees their pension.... not good.

And an exceptionally pithy summary of WSJ's "Unprepared" series, which I've been faithfully posting but for some reason Search isn't finding.

FUN FACT: the median retirement savings of a 65 year old in the US is $172,000. The average cost of living is $18,000. But the average retirement savings is $104k and the recommended retirement savings for 65 is $1m.

A consumer survey in 2018 found that 42% of respondents 65 or older had zero retirement savings. The maximum social security benefit (if you retire at 70) is $3700 a month. The average social security benefit is $1400.

You know what an "entitlement" is? It's something someone is owed. You know how everyone wants to balance the budget? "cutting entitlements."