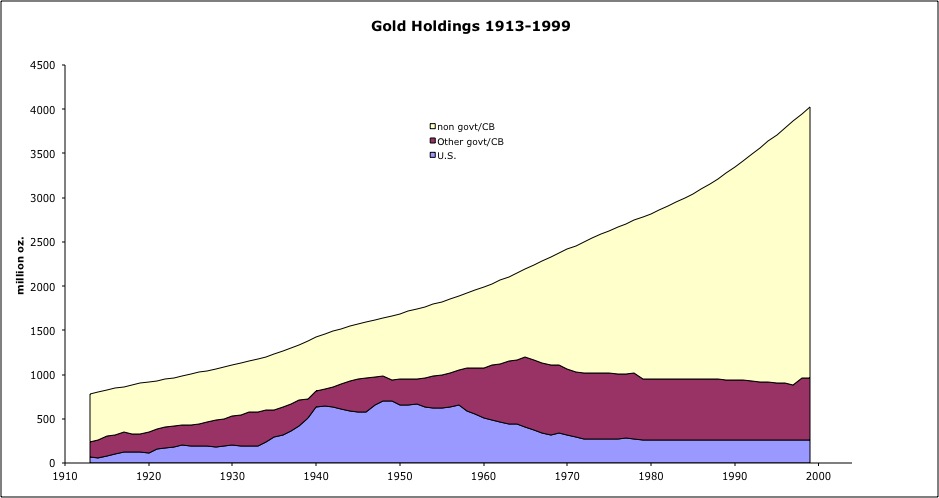

I've wondered to what degree Bitcoin's value is actually based largely on "tax evasion for everyone", and not on all the things crypto nerds dream about. I have lost all faith in it ever being a transactional currency. While I don't really understand the whole "store of value" debate, I do see Bitcoin as gold that you can transfer within a day to anyone. Taking a $6 trillion estimation of the gold market, Bitcoin could reach almost $400,000 just to be equivalent to gold. Even if you take a more conservative $2 trillion, that's still a lot of room for growth.

Gold is a curious one, too. Not adjusted for inflation and the gross world product does something similar: https://media.treehugger.com/assets/images/2012/02/indicator2_2012_gwp.PNG Gold has a use, though. Most of that which is mined is used industrially and commercially which takes it out of circulation as a marker of value. Looks like half to two thirds of gold is used in jewelry, for example. Still puts that number hella higher than it is now.

The best way to think of Ethereum is as a preinvestment in runtime on a globally-distributed mainframe. At the end of the day, all any of us have is energy and time and it takes time and energy to execute commands on this network, which takes time. Ether is the unit that measures that energy on the Ethereum "machine." Strictly speaking, Ether is one of the only cryptocurrencies that has a non-zero intrinsic value. That intrinsic value is directly related to the utility of the machine running it.