Can I get an ELI5 on what's going on?

Nobody wants to lend their money because they'd rather hang onto what money they have. So the Fed is basically saying "we will make sure there is always money to lend by providing up to a trillion dollars in extra money between now and April first." Note that these are overnight loans, so it's not like they're just... printing money. That job falls to Mitch McConnell.

What’re the odds we’re gonna see hyperinflation anyway? Pretty good, I think.

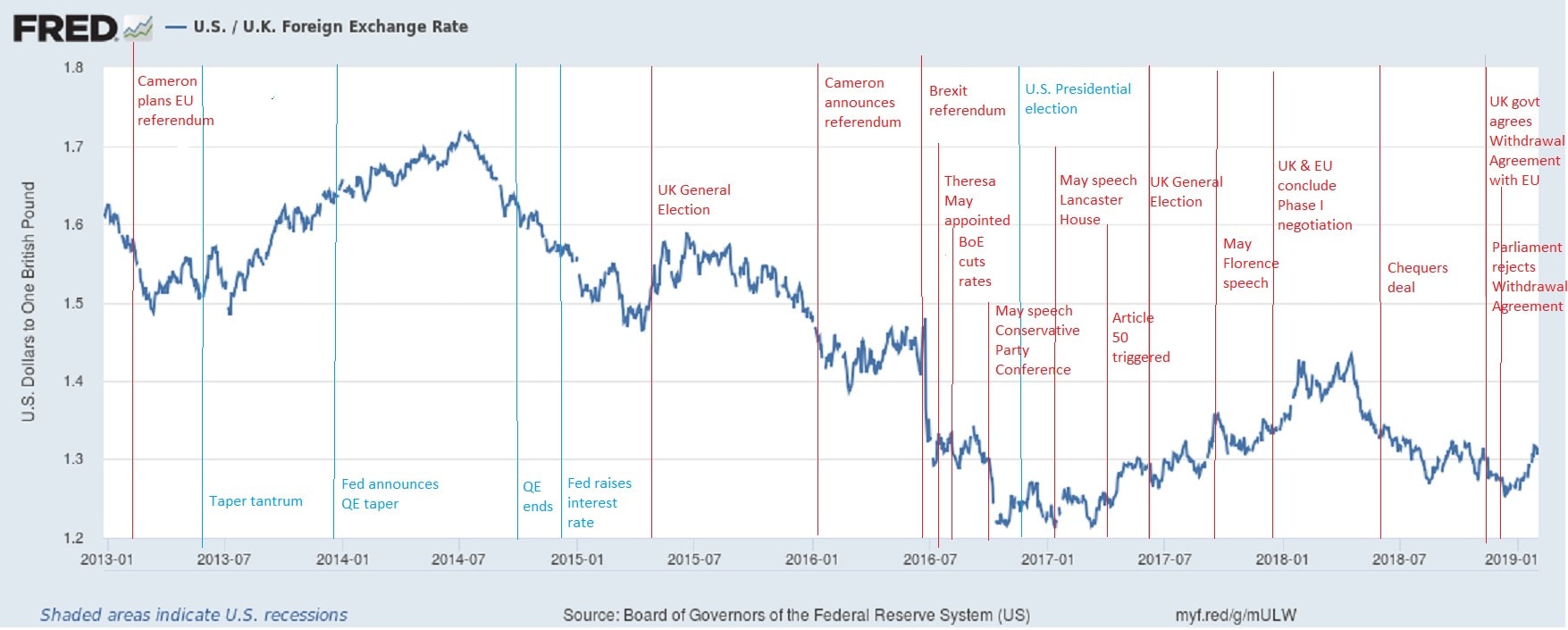

The part in question is "hyperinflation against what." The Weimar Republic experienced hyperinflation because the rest of the world said "you fukkas have no money and any number divided by zero becomes a wheelbarrow full of reichsmarks." This is also what drove (drives) Zimbabwe's hyperinflation: there's no way to estimate the intrinsic value of Zimbabwean dollars because Mugabe printed whatever he wanted to pay for a war against Congo and his government hid economic figures so that you pretty much had to take his word for it and the world didn't. From a microeconomic standpoint, if you sell eggs, and I need to buy eggs, I need to make enough money at my job-unrelated-to-eggs in order to feed my egg habit for society to continue apace. If dollars were discovered to cause cancer tomorrow you would find that people would improvise something by Tuesday. Maybe a dozen eggs cost you $4 yesterday - if they cost half a Pokeball tuesday you aren't really troubled unless your wealth in Pokeballs isn't equivalent to your wealth in dollars. Things hit the skids when I need to buy my eggs from somewhere that never had dollars. Forex trade of a lifetime right there. That's the world spending about an hour trying to figure out what Sterling is worth in a post-Brexit world. And it's been a lot more exciting than ever before because, well, there's a lot of shit to figure out and there will be some profound changes to the British way of life but fundamentally, it's not like a Brexit vote suddenly wiped out the British economy so the picture has been less... abrupt. So really: if the Eurozone, England, BRIC, the USA all do exactly the same stimulus and all achieve the exact same thing with the exact same amount of elan and aplomb, our hyperinflation gets cancelled out and everything's all good. But if, say, the USA dumps $3T into the US economy to keep things afloat and China doesn't have to, then there will be a flow into Chinese bonds which will cause a massive rise of the dollar against the Yuan - ...except for the fact that China owns lots of US bonds and the Yuan is pegged to the dollar so that Chinese exports continue to be cheap. Imagine a future in which the only three retailers in the USA are Costco, Walmart and Amazon. None of them are known for their stringent "Made in USA" requirements. Suppose the Yuan gets expensive - how the hell are Americans going to be able to buy cheap chinese crap with their wheelbarrows full of dollars? Or are they going to rush to gold, as the preppers have constantly supposed? Note that those prices go crazy pretty much where people aren't losing faith in the government, it's where they're losing faith in the stock market. Interest rates went to 11% in 1980 because Volcker and the Fed decided to kill inflation and, although it's taken 30 years for people to stop spitting on the ground after they say "Volcker", it worked. - "Satoshi Nakamoto", Bitcoin genesis block So what are the odds? I dunno. I don't know where you draw the boundary around this system. I don't know what you get to call an externality. We're in the delta.

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

That sterling trade at around 14:30, as circled in red, it kinda irks me. It's from 2017. Are there not high-frequency trading algorithms permitted into the sterling exchange? I think if there were, the sharp drop, over like 30 minutes, might not've happened, no? I guess I'm not understanding how Brexit relates to a one-hour dip in sterling, either. There wasn't anything significant happening that day, right? As for everything else, check.

I'm not sure. Big inflation has been predicted since '08, and interest rates are now falling. I think now's the time to print until the presses fail, inflation be damned. It's a crazy econ experiment when the economy goes from pretty good to 0 in the space of a week. If I'm not mistaken, the restaurant bizz employs more people than any other, any it just disappeared in a day. This is full on SciFi for economists, so I think predictions are gonna be hard, especially about the future.