Riight, so if I understand you correctly this part of the Bloomberg article (which admittedly is better than the one I linked) isn't the big deal, it's this: So is that sentiment, in the current environment, the investor wisdom-of-the-crowd that short-term castle-in-the-sky speculation is the way to go when mid to long-term the shit will hit the fan? The root cause is that many of these long-standing chains are overloaded with debt—often from leveraged buyouts led by private equity firms. There are billions in borrowings on the balance sheets of troubled retailers, and sustaining that load is only going to become harder—even for healthy chains.

Until this year, struggling retailers have largely been able to avoid bankruptcy by refinancing to buy more time. But the market has shifted, with the negative view on retail pushing investors to reconsider lending to them.

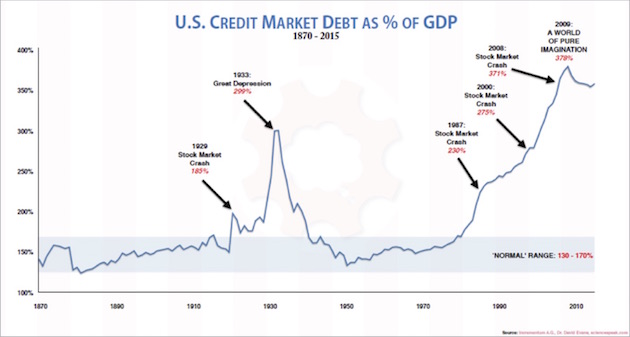

Simply put (a retelling of the New Republic article): 1) Large equity firms have been purchasing retail because it's distressed and therefore an opportunity 2) These firms have been financing the operation of retail through high-yield bond issues which have been largely successful because high yield is almost the last game in town where you can make money 3) High-yield bond issues (retail and otherwise) are no longer attractive to investors because, well, because the bond market is starting to see the writing on the wall, frankly 4) Retailers, who like everyone else close out and reissue bonds rather than waiting for them to mature, can't find any buyers for their bonds which means they can't refinance, which means they can't get any more credit, which means they collapse, which means they take down existing bondholders, which means the utter annihilation of disturbing amounts of capital. The fact that it's 2% means that the bond market will pretty much let it happen. The fact that "retail" means "things people buy" means that there will be ripples. UBS has been freaking out about this for two years now: Note that retail is in the noise on that graph. And that graph is two years old. There are two ways to look at this. On the one hand, people have been chicken littling the sky falling for three years now and we're still alive so maybe credit markets are hunky-dory. On the other hand, maybe we've been piling it higher and deeper those past three years so when it crashes, it's gonna be bad.

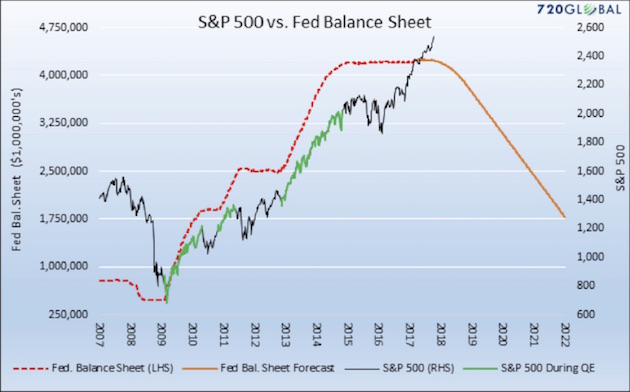

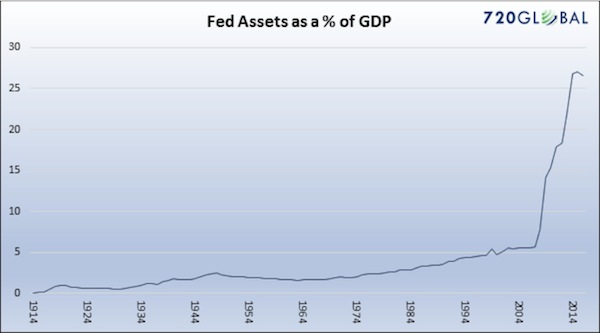

Just to add, because this graph has been much on my mind of late: The wiggly black line is the S&P500. The wiggly green line is the S&P500 on drugs ("quantitative easing" or "the government buys up a bunch of shit so there's money out there"). The dotted orange line tracks how much shit the government has bought up so far; the solid orange line tracks what the Fed has declared they intend to do with all the shit they've bought (dump it like it's on fucking fire). There's two ways of looking at this, too: on the one hand, the S&P is climbing without the government buying it so clearly, the experiment worked. On the other hand, the government hasn't dumped anything since 2008 and when they did, things went really badly so maybe this isn't a great idea hey?