No. Fuck you. No. "Will live forever as a meme". How can you trust someone as myopic to talk about a whole generation?This trend has become so pervasive that the very phrase “millennials are killing” will now live on forever as a meme.

The broader media viewpoint is that if millennials trusted anything they'd be much easier to sell to. It is their very distrustfulness that is killing Applebee's, golf, condos and everything else their parents hold dear (and have their retirement funds invested in). 6.7 trillion poured into the market last year. 400 billion poured into crypto last month. ain't none of that propping up Walter and Mary's 401(k) and they're scared shitless. And the sooner you realize it's all your fault, the sooner you can get back to feeding the machine.

Oh noes. You're telling me people gotta swim with the tides if they wanna prevail? </sarcasm> Suppose I know nothing about retirement, 401(k) or cryptocurrency. What's the big deal?

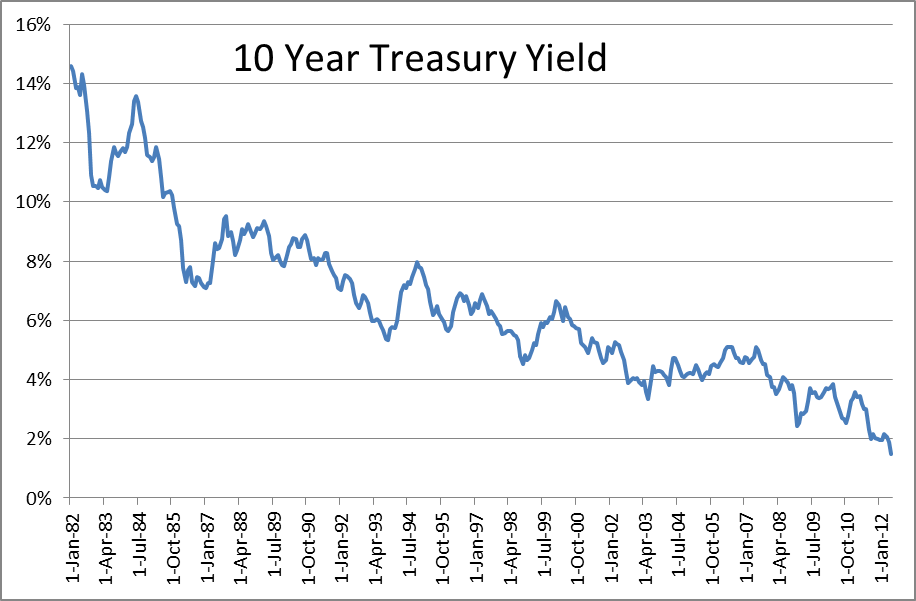

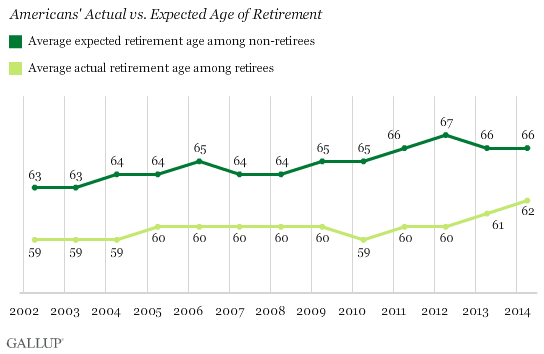

A large, uncertain but important question. Here's the American perspective, anyway, since ours is the only one that matters as you well know. Once upon a time people who worked a middle-class job got a middle-class pension - basically, your employer (or your union) took some of your money and put it in a fund where it would grow at 6% per year through prudent investment. Then when you were old they kicked you out and gave you a monthly check. This is on top of social security payments - basically, you turn 65 and you get a gold watch and two checks to live off of until you die, which will hopefully be soon because capitalism isn't made out of money in this one narrow definition of capitalism so stop asking. then in 1973 a bunch of rich fucks from Kodak decided that pensions were for chumps, they wanted to play the ponies with their own money rather than expecting Kodak to do it for them. This warped the tax code such that companies saved a lot of money by taking their employees' pension contributions and putting it in a fund that the employee themselves had to manage. But hey. Today's baby boomers were just a bunch of whiney-ass kids back then and they were never going to die so they gave no fucks. this was so great for the corporations that they basically stopped doing pensions at all, which made people have less reason to work there for very long, which gave the employers an excuse to stop paying people so much, which gave rise to a shortfall where all of a sudden the investment class decided that they'd figure out a way to sell retirement plans to people who had no 401(k)s or pensions and all of a sudden there were three or four different flavors of Individual Retirement Accounts (IRAs). And now everyone is their own capitalist and masters of their own destiny and everything was better for everyone. There was a sleight of hand in there, though - used to be your employer took care of you after they'd used you up. Now you and your money has to run a gauntlet created by stock brokers and the investment class and, by the way, you're now an individual investor attempting to recreate the leverage and professional management of a large-scale pension firm. Better yet, the "stick your finger in the air and guess a number" appreciation rate since the late '80s has been 6%. We're now saying "expect 3%." here's why. Hey, how 'bout life expectancy? What does that look like? So. A system created when you had 13 years to live off of what your company saved for you with 10% returns has become a system where your own madd investment skillz have to keep your ass alive for 25 years at 3% returns. ________________________AND______________________________ Nobody is a professional investor. They buy what they know, and they buy what they're told, and because of the perversity of retirement plans, the easiest thing they can buy is publicly-traded equities. Big companies. Big brands. the big dumb things the 'boomers have been building on either side of every 4-lane blacktop in the USA because, li'l secret, you've picked every brand you'll ever love by the time you're 25. If you were 24 when Applebee's was the hot new thing, Applebee's will be the hot young thing until you're a toothless geritol-sucker. Target. Toys'r'Us. Chevrolet. Gap. Zales. To you, millennial turncoat, these are the jurassic fossils of a consumerist era that never served you in the slightest. To the 'boomers they are unchanging monoliths of American culture, as permanent as the Rockies, as certain as day follows night. and you're fucking everything up. Pretend you're 58 years old. Your retirement fund took a massive kick in the nuts in the 2008 recession and has just now recovered. You were going to retire at 65 but now you're hoping you'll scrape by when they force you to retire at 70. You're desperately attempting to make the gains back on your portfolio that will allow you a Golden Age of something other than dogfood and camper vans but these fucking kids aren't eating at the restaurants you know, they aren't buying the brands of clothing you know, and the ungrateful wretches aren't filling your coffers by frequenting the stores and industries that make up your "blue chip" portfolio. they are leaving you to starve. ________________________________________________________________ Honestly speaking? Capitalism is getting sick before the 'boomers are. The kids are adapting because kids are adaptable but the old folx are reaping what they sowed 40 fuckin' years ago. Worse than that, they fucked their kids over so Hunter and Britney are still pulling down $1500 a month in assistance to live with three roommates in a 900sqft 2br three miles from Venice Beach while they intern for free at Google (a stock you sold when you thought it would top out at $500). Fortunately, Bitcoin is dead, having retreated to historic prices we haven't seen in at least 50 days. Hunter has stopped falling behind on his student loans ever since he gave up the acting classes and started driving for Uber with his free time. The kids are finally settling into a routine, so let's pile more money into Darden stock because if there's one thing that's eternal, it's fucking Olive Garden. At least, it fucking better be. Because we've got $300k between the two of us and according to Quicken, we burn $150k a year right now and that's not the retirement "they" promised us when they dissolved our pension fund in 1974. MAGAMAGAMAGAMAGAMAGA. good thing we'll make $1100 a month each in social security. We could buy a used motor home and drive it down to Baton Rouge and make that work. Maybe by the time Tiffany and Hunter need their social security they'll have figured out a way to make it work; since we'll be dead and buried it won't be our problem. ________________________________________________________________ And that, my fine Russian friend, is why these discussions are always framed in terms of "millennials are killing X": because the twilight years of millennial parents are nakedly dependent on millennials keeping X on life support and when they don't, 'boomers see death staring them in the face.

Thank you. What would be a better way to invest into one's retirement int the US? Also, in case I ever time-travel: would investing into GOOG be a certain long-term profit? Seems like their stocks rose from 50/piece to 1500/piece in ten years. Am I looking at this the right way? (I'm asking all this in presumption that you're enjoying or, at least, don't mind answering because of all the other big stuff you keep posting in the comments)

Yer a wizard, 'arry! You found the problem again! Here, follow along: - PENSION used to be: this thing where the money was invisible to you and would pay a dividend forever so long as you're alive, with spousal benefits when you die and all that great stuff - PENSION is now: this thing that you got pennies on the dollar for because fuck you, working man - 401(k) used to be: a retirement plan that you and your company poured money into and then the money would pour out when it was time to work on your ship-in-a-bottle collection - 401(k) is now: a retirement plan whose value dropped by 50% in 2000 because you were tech heavy, another 50% in 2008 because you were finance-heavy and sat there like a turd from 2010 until last year because no amount of Fed Reserve gas on the Stock Market bonfire did anything - IRA used to be: a self-guided meditation in building a healthy retirement through your ability to make money on damn near any stock you bought - IRA is now: every bit as shitty as the 401(k) except you can only put 1/6th as much money into it which, fukkit, it's not like there's much to put in anyway Of course, you can buy real estate with your IRA. Or cash it out with heavy penalties to try and make it rich some other way. That skunked the shit out of a lot of people in 2008, too - instead of being underwater on one house they're underwater on five and their retirement was wrapped up in a bunch of assets that depreciated 40% and also cost more than they could afford. Keep in mind: these are 'boomer options here. Punk-ass kids in their 20s and 30s don't have a lot of exposure to any of these options. They've been encouraged to "freelance" and "gig economy" their way to success and unless they've taken it on themselves to set up a self-directed IRA, they have no savings anyway. Which means they aren't pumping money into the market. Which means Bob and Sue's stocks aren't increasing in value because there aren't a bunch of whipper-snappers buying into the market. Also keep in mind: all these options are confusing and Americans get no education in finance whatsoever. We're left to figure it out on our own. The guy who managed the retirement stuff at the first company I worked at out of college thought Mexicans spoke Latin; "why else would they call them Latinos?" You're talking business majors and accounting majors who didn't go on to an MBA; the guys who picked their majors based on having Fridays off are giving you investment advice. Have we set the scene? We've got a bunch of earnest mutherfuckers who, for the past 40 years, have done exactly what everyone told them to do. They've saved as best they can. They lost their shirts several times because they went with the crowd (safety in numbers after all!). The basic marketing ploy for financial services in the US is "you're a fucking moron, do what we say" or "this shit is entirely too simple, even a fucking moron can figure it out" yet they still can't retire the way they were promised. Let's say Hunter found out about this cool thing called Bitcoin in 2014. He bought one for $300. It went up to $600. Cool! It went down to $300. Lame! But it's still worth $300. Then let's say he heard about this other cool thing called Ethereum. he can turn his one Bitcoin into Ethereum at a 2000:1 ratio. So he does. If you're Hunter's dad, you've been scraping your entire life and you're not sure if you're going to be able to retire on your $172,000. If you're Hunter's dad, that $300 of your money made your son two point two million dollars. Do you sense the raw, naked unfairness of it all? Can you taste the anger at the whole of cryptocurrency? Never mind that it's entirely beyond your ken; it's so deeply, divisively unfair. Google IPO'd at $85 13 years ago. With splits, one share at IPO (which you couldn't buy for less than $400; it was a freak show) would be worth about $2200 right now. And if you were the 'boomer that pulled that off you're the envy of all your friends. If you bought $85 of Bitcoin last January it'd be worth over $1000 right now, "death of Bitcoin" or not. And if you bought Bitcoin last January you're probably a millennial. Millennials kill everything. Because if you can't blame the millennials, you have to blame yourself... and the 'boomers really don't see what they can be blamed for. It's not like they did this. It just happened to them. And that's got them so pissed off and scared that they can't even pay attention to how much more fucked the millennials are.What would be a better way to invest into one's retirement int the US?

What would be a better way to invest into one's retirement int the US?

I totally wasn't laughed at here when I suggested adding finances to the curriculum. How much are the millenials fucked? The gig economy? The rising land/home prices?Also keep in mind: all these options are confusing and Americans get no education in finance whatsoever. We're left to figure it out on our own.

And that's got them so pissed off and scared that they can't even pay attention to how much more fucked the millennials are.

Your dispute in that thread was about "adulting" for want of a better term. How to pay taxes, how to read a mortgage statement, etc. I'll point out that I didn't laugh at you, although I am of the opinion that the fundamental basics are covered. I'll also point out that we're beyond "how to read a prospectus" here, we're at "how to make passive income in an environment where you have neither the leverage nor the knowledge" and that's a bit more than a chapter in Home Economics. Whelp... - there's a social security shortfall that hits in 2034 right now. That's gonna paste everyone under 49 unless something changes. - Older adults didn't do as well as they thought they would so they're staying in their jobs longer. That means kids don't get promoted and the lower end stagnates. - full-time jobs, those with benefits and retirement plans and the like, took a hit during the recession and didn't really recover. That's the obvious shit. Here's the scary one: In your lifetime, the number of wage earners to entitlement users is going to go up 50%. In the US, the "old age insurance" program (social security) has been in the red for six years already. Fundamentally? the average 'boomer is 65 right now. The youngest just turned 50. Over the next 15 years the rest of them will stop working. They'll be effectively removed from the GDP, their spending will go way down, and they'll become a giant drain on health care. Meanwhile all the kids the millennials didn't have won't be moving into entry level jobs because they don't exist and all the taxes necessary to pay for all these old fucks won't be collected because there won't be taxpayers to pay it. But the old people will vote, and they'll have kids who need to pay for them, and the whole of the country will be given over to putting them up somewhere and playing Bill O'Reilly's Greatest Hits for them while the rest of us try to keep the economy churning along with a massive entitlement burden, a reduced labor force and a demographic inversion of pure shit. And retirement? It'll be a thing we used to have. That's how fucked the millennials are.I totally wasn't laughed at here when I suggested adding finances to the curriculum.

How much are the millenials fucked? The gig economy? The rising land/home prices?

I'm sure you can spot the problem — and the solution — yourself. I haven't a clue if it's even possible to gain leverage against the whole stock market on the personal level, but I'm sure we can alleviate the other ailment. ("We"? Not you or me. How many financial specialists are there in the US?) Hence, "classes", not "a handful of lectures". According to your own prognosis, young people today would need a lot of help because their parents would be fucked. Implement one step of the Adulting Program (which is a terrible name, but — "for want of a better term"), and you're in the black. Speaking of which: let me recount. - old folks getting older and leaving jobs, not paying (as many) taxes - young folks getting older and leaving entry-level jobs — and a void in their absence - younger folks working fewer since being fewer, tax income for the state shrinks - older folks will need care for, will receive less since... - everyone sees decrease in health insurance, no one can do a damn thing about it If I follow — and feel free to correct me if I don't — this results in: - young folks getting sicker, which inevitably means decrease in production and, therefore, decrease in GDP - older folks not getting any healthier, but with fewer dollars per illness per head, fewer of the older folks are getting treated, leading to more preventable deaths - younger folks would be forced or lured into working to compensate for the sudden massive void where money used to be 20 years ago - nobody wins, everybody suffers Am I getting near?I'll also point out that we're beyond "how to read a prospectus" here, we're at "how to make passive income in an environment where you have neither the leverage nor the knowledge"

Yeah - adopt a modern, humanitarian system of providing for the elderly. Turning the whole country into stock traders is not a viable solution. There's absolutely zero reason to require people to understand a Bloomberg terminal in order to pay for their retirement. The basic problem is that capitalism has no empathy and empathy is necessary in providing for people in a noncompetitive economy. "How do we take care of a generation of old people" is a civics question yet we're trying to apply market solutions and the shortfall is coming evident on GenX and the millennials.I'm sure you can spot the problem — and the solution — yourself.

That's fair. I was aiming at trying to solve within the current conditions, rather than dealing with hypotheticals. We can teach people how to live with the hand they've been dealt. We can't change what they're being dealt as easily. A curriculum is a summer away. Social changes, especially with a whiff of socialism... you tell me how well that would go. Not saying I'm against it. I'm all for taking care of elderly in a humane fashion. Just saying, as you keep reminding me, that there are real-world obstacles to tackle before the dream comes true.

So this comes full circle: Market investment isn't a zero-sum game: by providing capital to enterprise, enterprise multiplies it and pays a dividend. If the markets can justify their existence, they should always go up. That's the fundamental underpinning of capitalism. Finance professionals (and geeks) separate market success into alpha and beta gains. Beta gains are what you get just by participating in the above. If you throw money at every stock in the market, your money should increase. Beta is what you get just for playing. Alpha gains, on the other hand, are what you get when you make more money than the average schlub. Alpha gains are zero-sum. For you to do better than average, someone else has to do worse. One succinct way to say all market stuff above - percentages diminishing, less returns, yadda yadda - is "diminishing beta gains." You can't educate your way out of that. All you can do is replace your beta with alpha. That's where the name comes from. From a basic game theory standpoint, if you educate all participants so that they can improve their alpha the only thing you will accomplish is making the game harder. It's like computer scams - we've gone from Nigerian princes to spearphishing secondary targets for access to bank accounts. If everyone stayed stupid we'd still be seeing all-caps entreaties for wire transfers. So again: the basic problem is that the baby boomers are outliving the capitalism they created. Most developed nations have some sort of demographic problem but none are as dependent on a free market solution as the United States, which is why I think we're going to have the starkest problems. Social Security is socialism. Medicare is socialism. Frickin' fire departments are socialism. My argument is we need more socialism.

If you ever write or speak about this in public, I'd like to see it: I want to know how well it goes. Not saying it's a bad solution: saying the crowd is tough on that front. Wasn't that one of Bernie Sanders' contention points — that he's a socialist? Because socialism equals communism, obviously, and communism is bad: bad enough that would rather wind up dead than red, isn't that so?Social Security is socialism. Medicare is socialism. Frickin' fire departments are socialism. My argument is we need more socialism.

Yeah - that was an argument against Bernie Sanders. Nonetheless, he just about won the Democratic nomination. Probably would have if the establishment read the tea leaves correctly.

I think what you said means "You need to acquire the Financial Lingo I skill before you can continue". That's alright. I'll get there someday.

Sorry for the jargon. If you're interested in learning, I recommend reading the Bogleheads wiki: https://www.bogleheads.org/wiki/Main_Page