LinkedIn sends me surprisingly good email. They've posted this, with the following linked stories:

- Data from the banking industry is showing that the slow US economic expansion may be about to stall. In its quarterly report on the sector, the Federal Deposit Insurance Corp. found that total loans and leases by banks and other insured institutions rose by just 3.7% from a year earlier at the end of June. That is the third consecutive quarterly deceleration and is down from a 6.7% pace of growth a year ago.

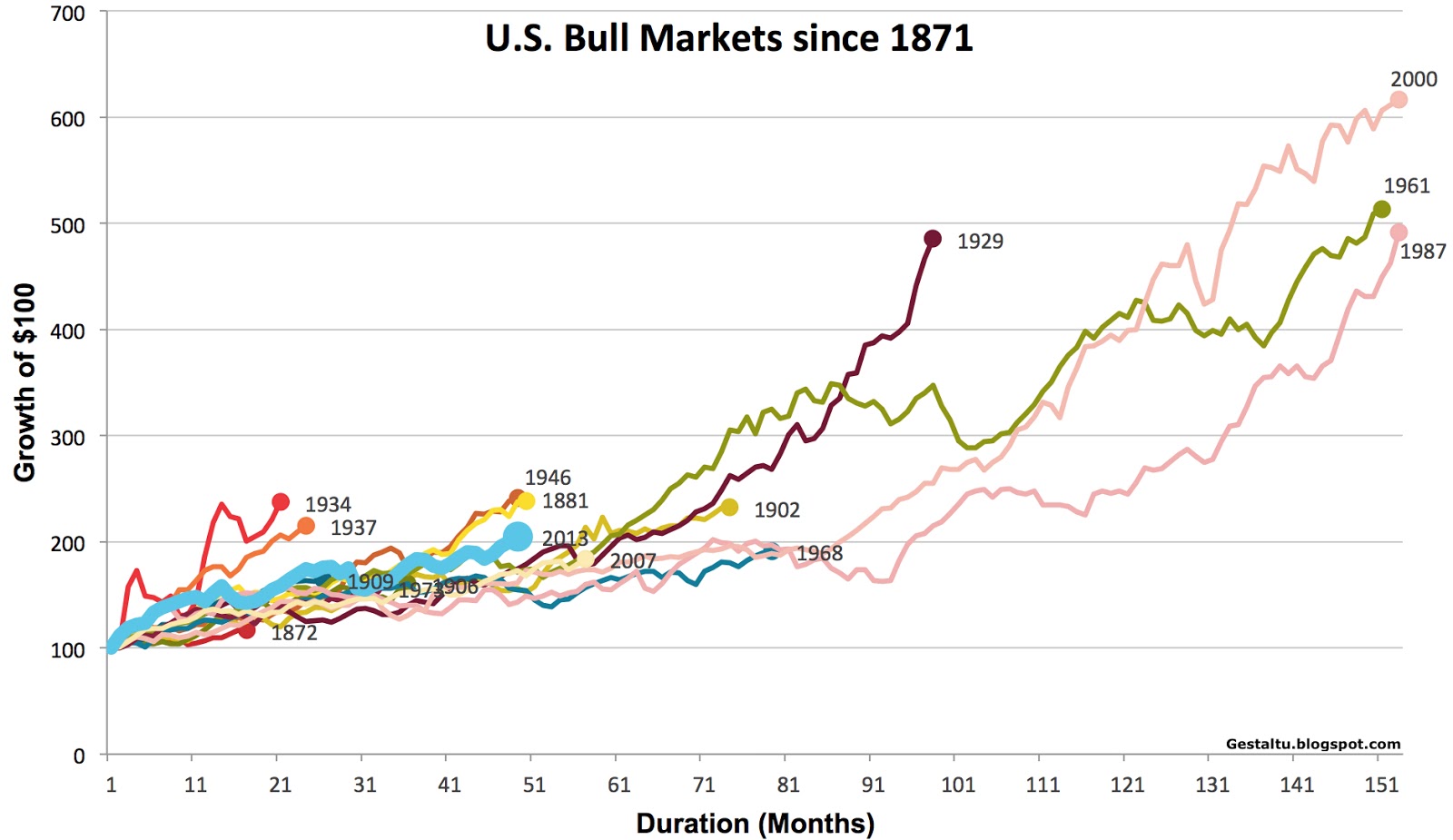

The macroeconomists have been howling from the rooftops for the past year or so. David Rosenberg, the guy who called the 2008 recession the earliest, said we're in the 7th inning back in April. He was also the first guy who went bullish in 2010. "Rosenberg pointed out that since 1950, there have been 13 cycles where the Federal Reserve tightened interest rates… and 10 of them ended in recession." It's been argued by a number of people that the Fed is wedded to the Phillips curve, which is basically a straight correlation plus a fudge factor. Just as many people argue that the Phillips curve is no longer applicable because of the structural unemployment caused by the last recession:.

What I've never been able to figure out, since the last recession, was when someone pointed out that growth numbers stack(1) and it's unrealistic to expect economies to just keep expanding and expanding without sliding back from time to time. You figure people would put into their financial models (whether they're investing or whatever) plans for what to do when the economy inevitably slides back. You know, to reduce hits to stock values, reduce layoffs, whatever. (1) At least, I think that's how I understand. For example, 5% of 100 is 105 and if that grows by 5%, then you get 110.25 and that .25 is the result of stacking.

I've read ZeroHedge on and off over the years... I feel that they've been calling for catastrophe Stateside for some time now. I've started to wonder if they cry wolf to get eyeballs - or maybe they're paid by actors with motivation to cause financial turmoil. Thoughts?

Yes, them and a bunch of others have been pounding the drums for a bit. I think some are talking about the sky falling down because they're selling gold and silver. I think some can see the system is unwieldy, but are don't have the skills to see exactly when it will topple. (For example, some years back Gerald Celente, a respected forecaster, noted that he was wrong about when because how was he to know about the schemes, band-aids, duct tape and QE that they would come up with to hold things together.) Then I started hearing similar rumblings of a catastrophe from more mainstream folks. I think it's like Martin Armstrong says. I think a lot of people are only looking domestically, ignoring the greater world economy when they make their predictions.