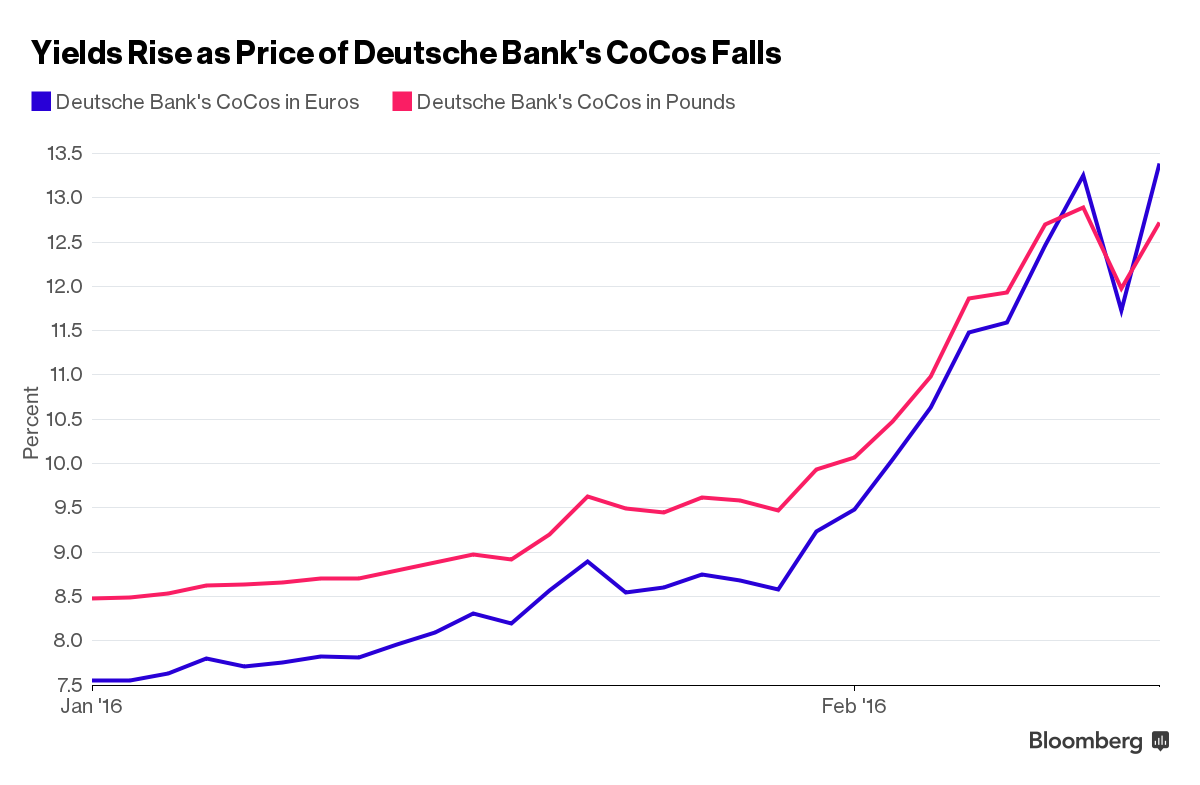

Except that they offer a deal so good for the banks that the rates they have to pay are f'n ruinous: Which, in a NIRP-world, provides quite a lot of drag on liquidity. If you're giving bond-holders f'n 16 percent while your intrabank rate is like -1 percent your costs of doing business are sucking. I'm no fan of banks but to my understanding, CoCos are the equivalent of a Providian credit card: things are great until they aren't, and then all of a sudden you are in.the.shit. Commence the debt spiral. The shit. I see it. It's over there. And we keep walking closer.

Well the way bonds work is that as the company you only pay the issue rate (which was probably generous 6-8% but not that crazy 16%). The market yield is set by the discounting of the underlying asset. Obviously you shouldn't really issue more because it would be very costly but even then issuing more cocos should theoretically not affect your capitalization ratio because once you hit that magic threshold all the Co-Co bonds turn into equity shares with no underlying obligations.

True enough, and a good clarification. However, it points to a bigger problem - if you, the buyer, are getting 6-8% for loaning DB money and I, the secondary market want 16% to take that bond off your hands, you're not making money. More than that, DB has a helluva time continuing to sell CoCos. From my understanding, CoCos amplify risk an outsized amount compared to their value because they have that magic "DB hits 12 poof you own stock" aspect. Worse than that, DB doesn't have to count the stock that goes poof until it goes poof, which means it also dilutes the fuck out of shares when it blows up. So it's not just that they're risky, it's that they externalize that risk to everyone else that holds DB, whether or not they own CoCos. There's a built in "cascade of bullshit" with convertibles in general but it's been held in check somewhat by the fact that the conversion is usually a litigation point. With CoCos that conversion point is writ in stone, which makes it rip quick and relentless. Finally, these are bonds that are being traded at 16% in an environment where nothing trades at 16%. Every trader I follow has been bitching about yields and how boring the market is these days and I think you, yourself pointed out that the problem with addiction to high-yield financing is that when the yield drops the cost of business spikes (can't find the comment, though). So the guys that are buying into CoCos aren't doing it on a lark, they're doing it because they've been painted into a corner by an environment where it's a stone bitch to make money. And now poof they're shareholders. In a failing asset. That they sure as fuck wouldn't have bought back when it was healthy; not without those 16% yields, anyway. And when the bonds convert, and the stock dilutes, and the share price has already been plummeting, it's gonna get messy on more than the guys holding the CoCos. It's gonna get messy on the guys that know the guys that know the guys that do business with the guys that hold the CoCos.

I agree with you that CoCos are bad for the buyer. But not necessarily for the issuer. The interesting question is who is the holder for these, and if I had to take a guess its likely going to be the dumbest money in the room (pension funds). They need the 8% yields to keep their balance sheets from ballooning out of control they they have been on a buying spree for all sorts of garbage like this and sub-prime auto loan. In the end, you and I will eventually have to pay for all the looses though increased city and state taxes. I'd be willing to wager that CoCos are not going to be the prime reason for the next big recession. The only way I can see them doing real damage to the financial institutions is if UBS owns DB cocos or vice versa. Then everyone is at risk for systematic failure.