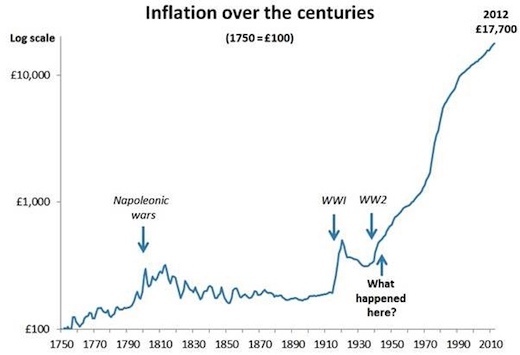

"Hello, there. I'm Lyn Alden. You might know me from my various appearances on Twitter, on the podcasts of Twitter people, in my responses to Twitter people and my appearances in podcasts about my appearances on podcasts about appearances. Allow me to turn 'your buying power goes down' into ten thousand words." You know how any technical writing or creative writing manual will say "Don't start by citing the dictionary?" They do this because it's immediately obvious that you don't quite know what to say, you lack the strength of your convictions to simply say what you think you should say, and you have a wordcount you're trying to hit. It's like how Twitter wonks will try to talk to the normies and light right into M1 and M2 money supply but skip right over fractional reserve banking. Look here's a news flash: inflation didn't exist until the adoption of gold standards. Piketty spends a full chapter on this, pointing out that pretty much until the dawn of the 20th century authors went ahead and put prices in their books because they never changed. If you look at old records the gold-to-whoozit ratio basically doesn't change. So whenever you see an economist proclaiming this, that or the other, know they're talking about like three data points and attempting to draw a curve: But ultimately, what are we left with? SO BRAVE I'm sorry, I'm in a shitty mood. And the tendency of "economists" to wrap themselves in jargon and verbosity in order to wow the rubes has always gotten sand in my shorts. To your observations: Inflation could be softened by raising taxes, raising interest rates and otherwise making people have less money to spend. There are only so many widgets that people need. If it takes four guys to make a toaster yesterday but only one guy to make a toaster today, people aren't going to run out and buy four toasters even if you slash prices 75%. Inflation punishes savers. It is the number one solution for eliminating sovereign debt. Can't pay your pension benefits? Inflation is your friend. Can't pay your social security obligations? Inflation is your friend. Can't pay your mortgage? Inflation is your friend. Here's the thing, though: 60% of student loan debt is owned by the top 40%. Mortgage debt is even less fair. Meanwhile wages tend to trail inflation, not lead them and the bottom half of the income brackets are most assuredly labor, not capital so no, in general inflation is not their friend. Poof. You own a McDonald's franchise. You've got 20 employees per shift. Four of those are cashiers who you pay $9 an hour. Suddenly a wild COVID appears! Those $9/hr cashiers have discovered that they can make $7 an hour sitting at home, also that McDonald's sucks. To get them back will cost you $11 an hour - they want to make as much as the fry cooks. The fry cooks, for purposes of the discussion, are fine. You're open 18 hours a day. Could be 24, but let's say 18. Each cashier is going to be an additional $36 per day on the face of it. That's $250 a week, $1000 a month, $12k a year. So. You gonna hire those $9 cashiers or are you gonna buy a $5k kiosk with a 3% business loan that lets you amortize the cost against your taxes for the next 24 months? And do please keep in mind that for every $1 you pay your employees you're paying 50 cents in taxes and overhead. Each cashiering position is costing you $110k a year across three shifts - more if night and swing are paid better - and you can kick that shit to the curb with a capital investment. Inflation helps the little guy how again?Whenever the balance of power favors the wealthy, due to some combination of offshoring, automation, and the political environment, then monetary inflation is more likely to translate into asset price inflation.

My base case going forward continues to be that with the combination of sizable broad money supply growth, along with public opinion pushing the pendulum back away from globalization, consumer price inflation is likely to be higher in the 2020s decade than in the 2010s decade.

- Could inflation currently be being softened by some sort of overall productivity increase?

- Moderate inflation actually helps the lower 50% of people because they have more debt and less assets.