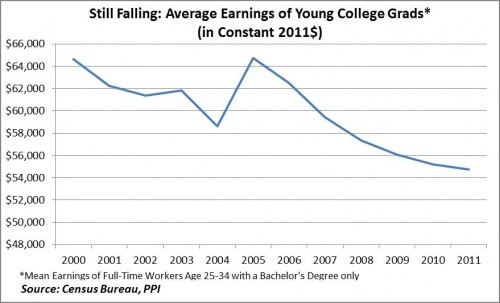

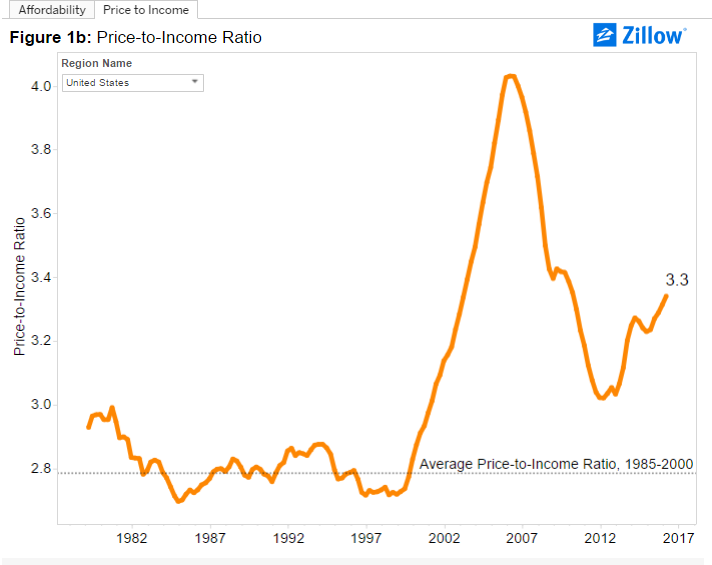

It's a total red herring. Here's the quote: They also want community, connectivity and inclusiveness, said Tony Ruggeri, the millennial co-CEO of Republic Property Group, a developer that is building large communities at Light Farms in Prosper and Walsh in Fort Worth. "We're not doing golf courses anymore, we're doing food and beverage," Ruggeri said. "And the concept of walls and gates, the instinct to insulate yourself from the outside world, that's completely inverted." So, they don't want picket fences, gates, or golf courses. They do want a house they can move into that doesn't need a bunch of rehabbing. Somehow that's "particular" as if the idea of renovating a home before selling it is this appalling ritual realtors have never been subjected to. You wanna see why millennials are buying fewer houses? It's gonna take me two graphs: My wife - nine months out of college - was making $65k a year in 1999. In February 2000 she bought a 1300sqft mid-century with 3 beds and 2 baths in a major metropolitan area within walking distance of a metro park'n'ride for $175k. We're not talking hoary rimes of 'boomers and Levittowns. We're talking "people who saw Green Day in college." That house is now $425k and that salary is now $56k a year. "Picky?" Good thing their parents are chipping in. For more than mortgage assistance. Let's spell this out, shall we? If you're under 35 and buying a home, there's a 1 in 5 chance that mommy and daddy are giving you the downpayment. Which is entirely appropriate because there's a 4 in 5 chance they're giving you money for rent and bills already. Great economy amirite?The pickiness point struck out to me, it makes sense that a cohort with house ownership harder to save for would be more picky when they did manage to buy.

"They're pretty particular," Barrios said. "They want a good price, something that's eco-friendly and something that's recently updated. You know, it's instant gratification. We all work a lot, so we don't have the time to do a renovation when we buy."

A recent survey by loanDepot shows that 17% of the parents of millennial children (defined here as between ages 18-35) expect to help their children buy a home within the next five years. That’s an increase of over 30% compared to the previous five years, when 13% of parents expected to provide home-buying assistance.

Most of the parents offering financial support for their children who are over 18 have either helped with living expenses (84%) or given their child (or children) money to pay down debt (70%).