The dumb thing is we had the problem largely solved. The dumber thing is most every country in the developed world doesn't deal with this stuff. The solutions aren't even hard, they just make the 'boomers cry. 1) Raise taxes on the wealthy. 2) Open Medicare to everyone. I own a business. I pay out more in salary every month than Cierra makes in a year. IN A YEAR. Tomorrow I'm going to go pick up my car and drop two or three of Cierra's monthly wages on a car repair bill. But if Cierra were to attempt to buy health insurance she'd pay more than me on the open market - after all, she's a woman of prime childbearing age with two pre-existing conditions (diabetes & obesity) while I'm a man in my prime. Hold the phone though. I qualify for benefits through my union (which makes me a fuckin' unicorn - I'm one of the 6.4% in a private sector union and of that 6.4%, probably one in five that qualifies for benefits). So I pay - wait for it - fifty bucks a month for my family of three. Cierra, meanwhile: That $400/mo "bronze" coverage? Probably has about an eight thousand dollar deductible. So. If Cierra wants to protect herself against the ravages of diabetes she can spend a hundred dollars a week on insurance that covers sixty percent of her expenses after she's spent eight grand. And no, the premiums do not count towards the deductible. Cierra, who makes $20k a year, is required by American capitalism to spend $13k a year on medical expenses before her plan covers anything. Of course, if Cierra were actually poor - $12k a year, not $20k - she's suddenly on Medicaid and shit becomes free. The system has literally twisted itself in knots to the point where should Cierra get sick, her best move is to stop working at McDonald's. She's actually ahead in this one - her other job is at a hospital! Cierra, under any sort of medical issue, does better by not working. And things are so dumb that were Cierra to wind up at the emergency room, the social workers would have to counsel her through the Red Pill adventure of "honey, it's time to get poor" because if she drops at work because her blood sugar sucks? And she gets an ambulance ride to the ER? She'll be looking at a $40,000 bill. ...which will magically go away the minute she drops below the poverty line. This stuff isn't ACTUALLY hard. We just need the people of the United States to be grabbed by the lapels and shaken and asked "is this what you really want?"

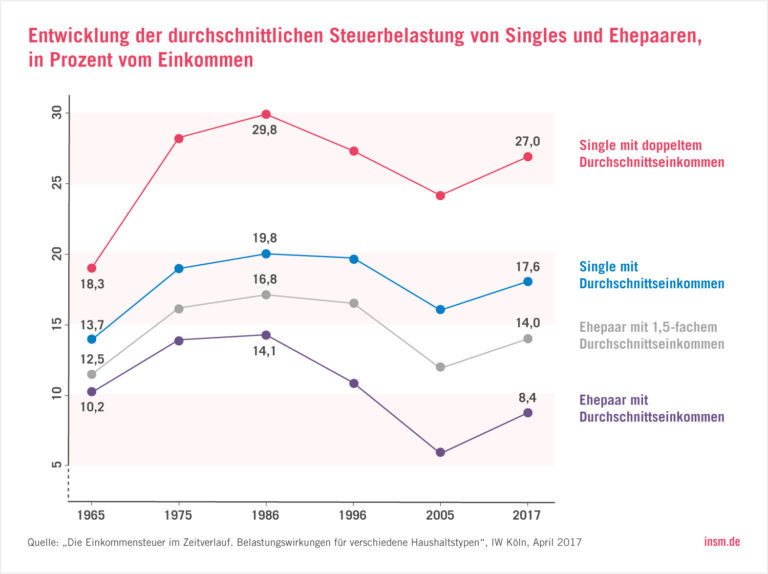

This tax rates graph is insane and probably the best depiction of "how this show went to shit, slowly" I have ever seen. Looking at it, to me the 1960s/70s had a "healthy" taxation. But thats only me looking at numbers and sensing some kind of fairness. But I might be mistaken. I tried comparing the graph to the current german situation but I am not able to find a similar one. The only one I could find that gives similar data is this one: Which looks at the amount of income tax one pays depending on whether they are married (Ehepaar) or single and how much relative to the average income the household earns. It doesn't look like much but I find it hard to compare them really. The highest earners have to pay around 45%, which this also dropped over the years, from 53%. What would you think would be a reasonable taxation scheme to "make it work"=

The battle over tax rates usually begins by picking at "actual" vs. "published" tax rates. Republicans love to point out that corporate taxes are high in the United States so our "actual" tax rate is very high (because obviously we're all corporations or some shit). As Thomas Piketty pointed out, the United States Treasury Department is basically the first organization that has decided to repatriate black market funds aggressively; considering something like a third of the world's economy is off-the-books, that makes the US tax rate theoretically very high. Does the Treasury's repatriation of offshore funds impact Cierra? I'll bet she's never been to Liechtenstein, let alone opened a hedge fund there, so this is a particularly Republican talking point. Not only that you can't really argue that "taxes leveed" and "taxes collected" are the same thing, yet most people do. Here's a decent discussion on taxation in germany. This is ugly: Perhaps the most annoying thing about doing all the research and reading all the books is that you discover that the problems that are described as intractable really are intractable. There are no pithy, simple answers. Fundamentally, rich people have more power to make laws. People who make laws have more power to determine how things are counted, for example, and rich people around the world have done a banner job of changing the metrics so that we measure economic health by "how are rich people doing." If you're rich, hardship touches you less; if you're rich, you have more options in the face of adversity. That adversity can include "poor people wanting to change the rules on you." One way to look at populism is as a shrewd maneuver by the unprincipled wealthy to ensure that the anger of the poor turns on the principled. Investigation finds ‘88% of Tory ads misleading compared to 0% for Labour’

As with most things Vox, it's largely correct but simplistic. At the very, very end it gets to the amount of money left over, rather than it being the principal problem. Their graph of deciles were tax rates, not overall wealth. In the US, the bottom decile makes less than $10,500. The top decile makes more than $184,900. The bottom decile pays an overall tax rate of 27%, the top decile pays an overall tax rate of 29%. So. The bottom decile has $7600 a year to live on while the top decile has $135k. Average cost of living is, of course, a highly contentious number, but let's go with these guys 'cuz we gotta go with sumpin' so... $20,194 per person per year. The bottom decile is a factor of three away from hitting the average cost of living - three people in the bottom decile could roll all their earnings together and one of them can pay the average. The top decile can almost but not quite pay the cost of living for seven people. Let's say we add the cost of living of one American to the taxes of the top two deciles - all of a sudden, the bottom decile can live with dignity and the top decile still has $110k to live off of.

That solution would only work if the lowest decile would magically earn double of that what they earn right now. How would that be done? Lowering their taxes is not going to help much. Increasing the minimum wage would help a little, but no one would double it, or is that feasible? Or a tax financed basic income for everyone that is as high as the average wage of living?

...and I know that more of my money should be going towards Cierra's healthcare. I drive a fucking Porsche (granted, a 20-year-old Schadenporsche, but a Porsche). I own my home. I have a kid in private school. But much like Cierra is beating 52 million Americans, 50 million Americans ARE BEATING ME. And I'm of the opinion that more of THEIR money should be going towards Cierra's healthcare, too. They've got lobbyists. They've got economic interest. But we're still one person one vote here and the time is coming where people aren't willing to spend three quarters of their salary to keep from dying of diabetes. We just need to stop being temporarily embarrassed millionaires.