Ben Hunt is rapidly turning into Zero Hedge on amanita tea. But hey. Shamans are often thought-provoking.

- Again, I’m not saying that the Quality derivative doesn’t exist as a real thing or that it isn’t an important factor in the history of successful stock-picking or bond-picking. What I’m saying is that the Quality derivative hasn’t mattered for eight and a half years with stocks and five years with sovereign debt. What I’m saying is that it might not matter for another eighty years. Or it might matter again in eight months. A Three-Body System is a chaotic system. As the boilerplate says, past performance is not a guarantee of future results. In fact, the only thing I can promise you is that past performance will NEVER give you a predictive algorithm for future results in a chaotic system.

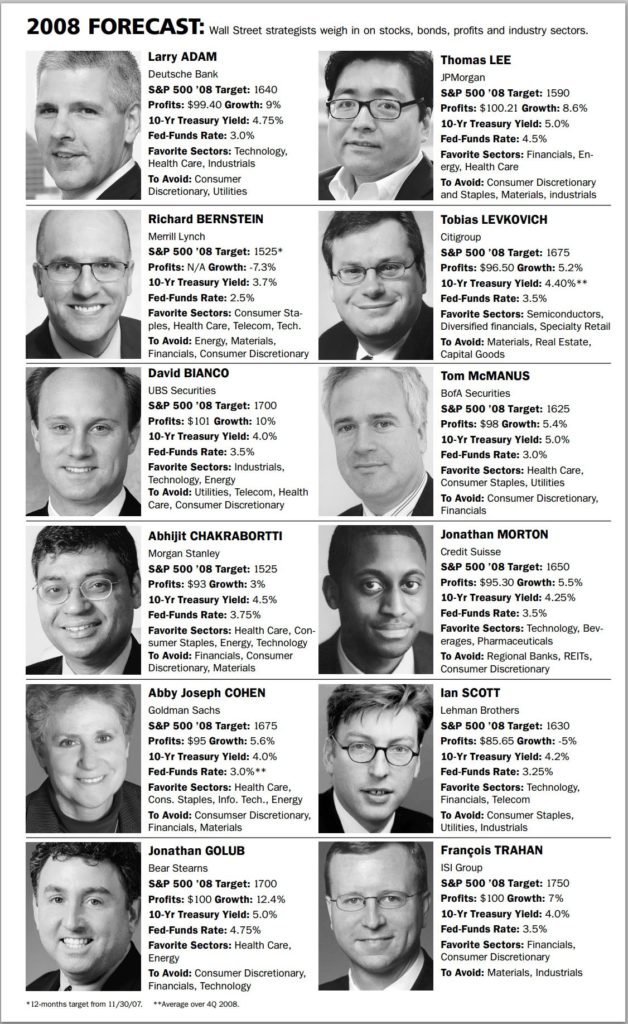

Keep your eye out for prognosticators.

(source - the S&P went from 1575 in October 2007 to 666 in March 2009)

- Because The Answer does not exist in the past. The Answer — which is another word for algorithm, which is another word for “general closed-end solution” — doesn’t exist at all in a chaotic Three-Body System.

THERE IS NO SPOON

It's interesting to think of economics as a chaotic systems, but I'm not fully convinced of that view by him. Economists say "maybe?" One does need to factor in that chaos theory undermines finance and economics.

I think what he calls "theory of narrative" is something that might still be a predictor of market movements, namely good 'ol market sentiment. Especially in this digital age of market manipulation being easy for whoever got in early enough, it might be interesting to figure out "real" (as in human) and "fake" (as in by bots and shills) sentiment and use that to see where markets might be going soon. Greater fool theory rests upon sentiment, doesn't it?

edit: also, I've been learning some more about scifi, is Cixin a good place to start?

posted 2324 days ago