LinkedIn sends me surprisingly good email. They've posted this, with the following linked stories:

- Data from the banking industry is showing that the slow US economic expansion may be about to stall. In its quarterly report on the sector, the Federal Deposit Insurance Corp. found that total loans and leases by banks and other insured institutions rose by just 3.7% from a year earlier at the end of June. That is the third consecutive quarterly deceleration and is down from a 6.7% pace of growth a year ago.

kleinbl00:

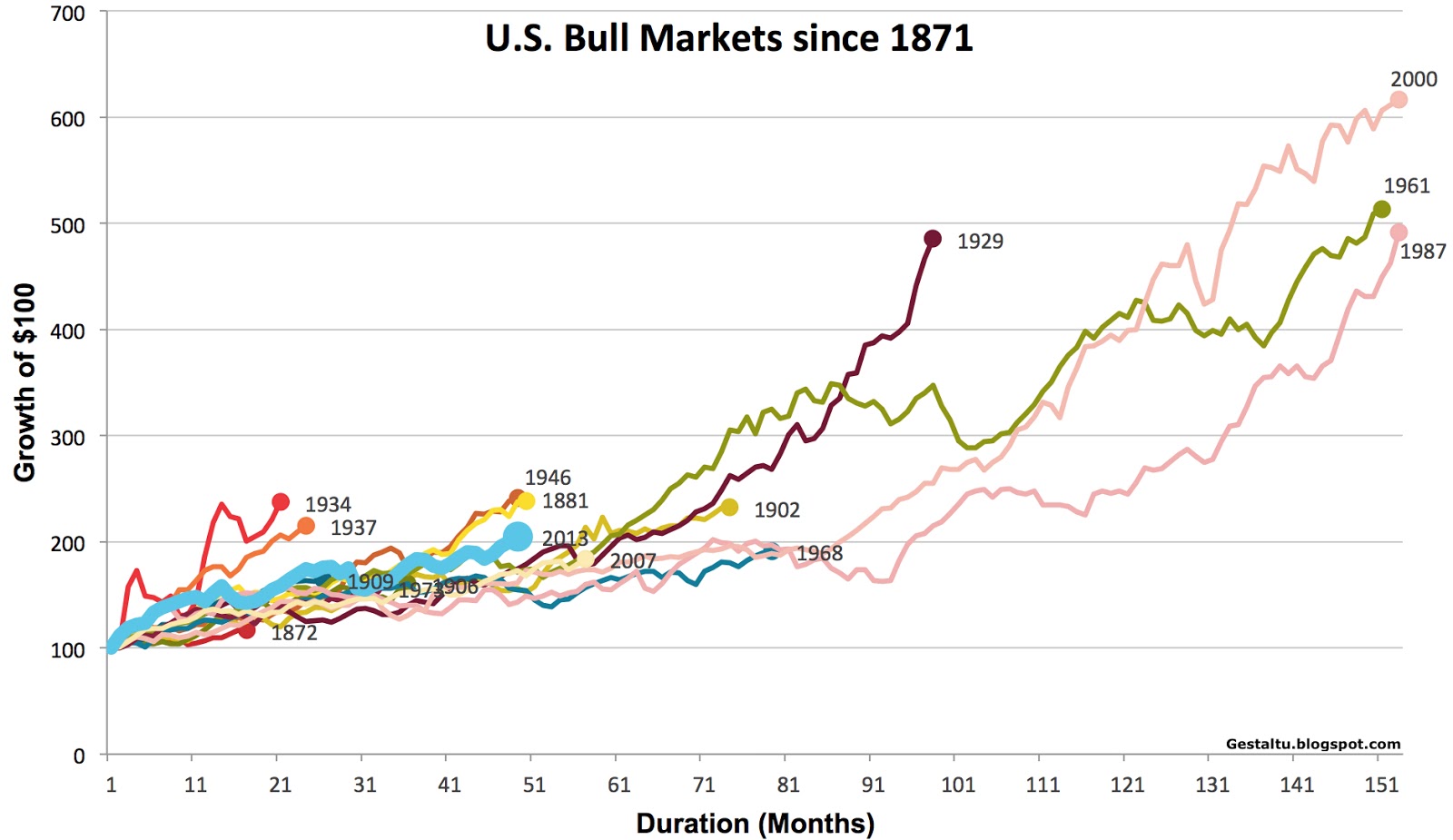

The macroeconomists have been howling from the rooftops for the past year or so. David Rosenberg, the guy who called the 2008 recession the earliest, said we're in the 7th inning back in April. He was also the first guy who went bullish in 2010.

It's been argued by a number of people that the Fed is wedded to the Phillips curve, which is basically a straight correlation plus a fudge factor. Just as many people argue that the Phillips curve is no longer applicable because of the structural unemployment caused by the last recession:.

We're at about 102 months, depending on how you count.

posted 2424 days ago