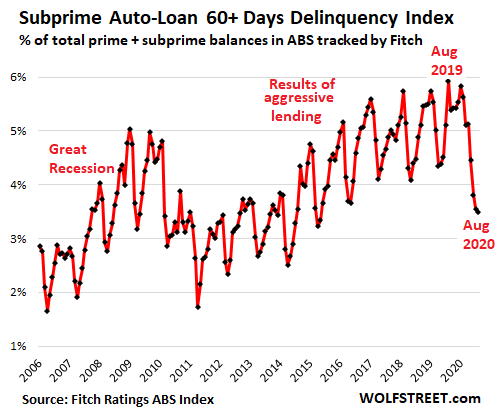

So here is what I don’t understand, you are seeing this in housing but yet you see this in autos. Source: https://wolfstreet.com/2020/09/13/subprime-auto-loan-delinquencies-loan-deferrals-stimulus-curdle-into-curious-phenomenon/ A lot of Americans clearly have had more money in the last 90/120 days and are using it to rightfully pay off debt it seems. Either that or we’re seeing some sort of extend/pretend game happening in auto loans that’s artificially lowering delinquency. That being said we should be seeing a similar extend/pretend going on with housing through forbearance so why aren’t we.

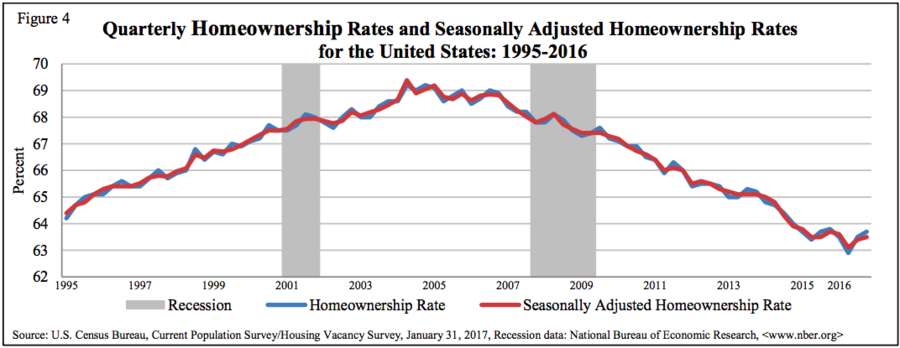

I can explain that. I can probably even find graphs. Hang on a sec. This is relevant: This is relevant: This is relevant I haven't seen refinance approval rates yet, but anecdotally they're in the shitter. And somewhere I've got (I've put up here) a graph showing that the bottom two deciles put their stimulus in the bank or towards debt, the top two deciles put their stimulus in the bank or towards debt, and the middle deciles put their money in equities. It works like this: if you're poor, you don't own a house. You "own" a car with a shitty rate and you could lose it at any minute. If you're getting extra money, the economic data indicates that you're doing everything you can to get rid of the ball and chain around your neck because contrary to liberal thinking, you aren't a fucking moron you're just poor. So while there's an eviction moratorium on missing rent, there's nothing keeping the bank from repossessing your car and then when the eviction moratorium is fuckin' over you won't even have a Nissan to sleep in. So you pay down the car. This was one of my favorite knock-on effects of the recession: Washington Mutual was one of the principal lobbyists to tighten bankruptcy rules. Which meant all of Washington Mutual's customers were stuck in predatory credit card rates. Which gave them a choice of which bills to pay and if they didn't pay the credit card, they'd end up with a lien, not a bankruptcy proceeding. So they stopped paying their Washington Mutual mortgage. Bye bye Washington Mutual.